Why Buying Cheap Home Insurance is Important

When it comes to protecting your home without breaking the bank, buy cheap home insurance is essential. You don’t need to sacrifice coverage for affordability, and we’re here to show you how.

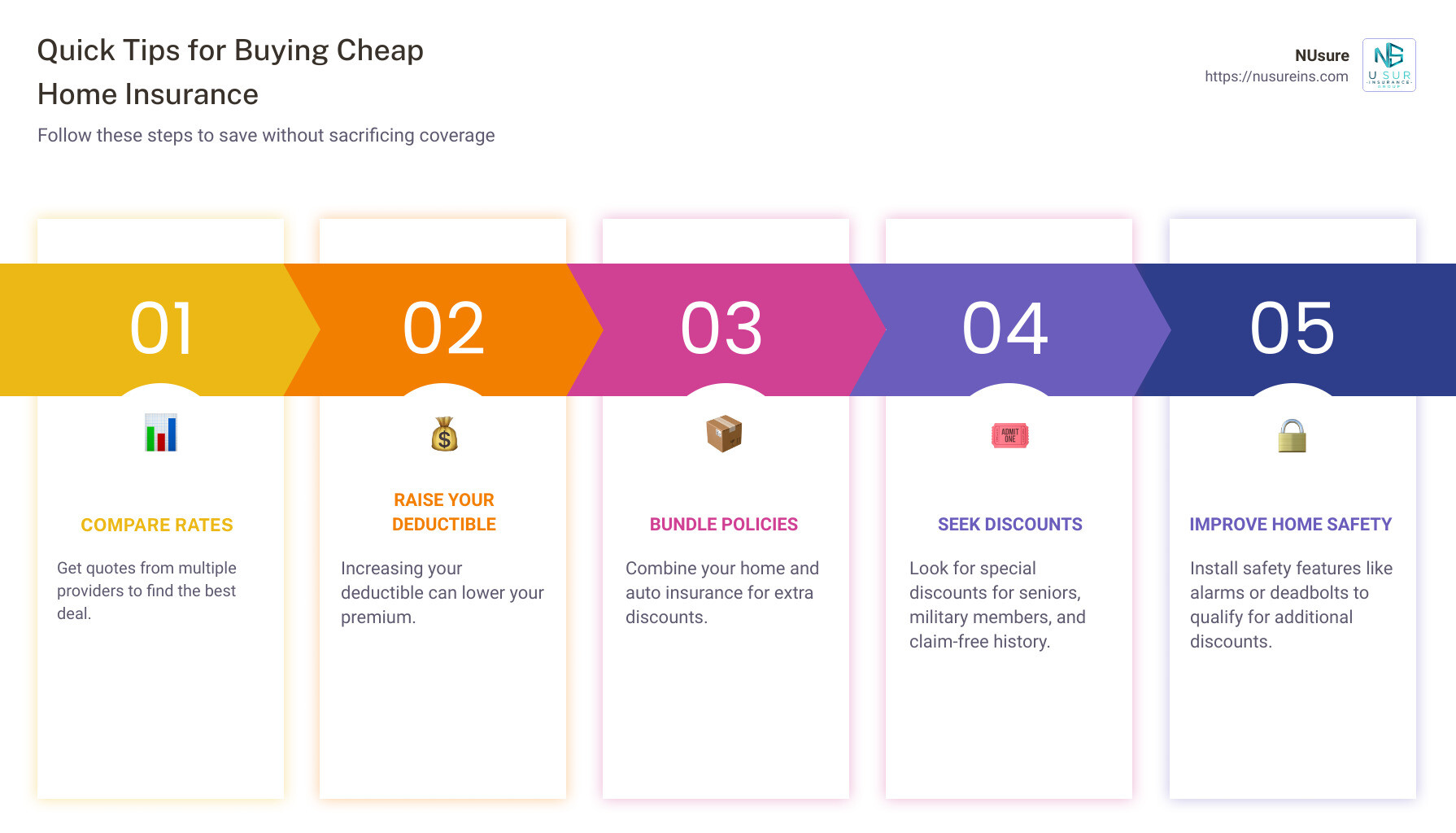

Here are quick tips to get you started on buy cheap home insurance:

1. Compare rates from multiple providers.

2. Raise your deductible to lower premiums.

3. Bundle policies for extra discounts.

4. Seek out special discounts for seniors, military members, and claim-free history.

As a seasoned Property & Casualty risk expert, I’ve spent years helping homeowners find the best deals. Trust me, buy cheap home insurance doesn’t mean settling for less protection. Let’s dive into how you can save more without compromising on your home’s safety.

Understanding Homeowners Insurance

When you buy cheap home insurance, it’s crucial to understand the different types of coverage included in your policy. Knowing what each type covers can help you make informed decisions and ensure you’re adequately protected.

Coverage Types

Homeowners insurance typically includes several types of coverage. Here are the main ones you should know about:

- Dwelling Protection

- Personal Property

- Liability Protection

- Additional Living Expenses

- Guest Medical Protection

Dwelling Protection

Dwelling protection covers the structure of your home, including the walls, roof, and built-in appliances. This coverage helps pay for repairs or rebuilding if your home is damaged by covered perils like fire, windstorms, or vandalism.

Example: If a tree falls on your house during a storm, dwelling protection can help cover the repair costs.

Personal Property

Personal property coverage protects your belongings, such as furniture, electronics, and clothing. This coverage can replace or repair items damaged or stolen due to covered events.

Example: If your TV is stolen during a break-in, personal property coverage can help pay for a new one.

Liability Protection

Liability protection covers legal expenses if someone is injured on your property or if you accidentally damage someone else’s property. This can include medical bills, legal fees, and repair costs.

Example: If a guest slips and falls in your driveway, liability protection can cover their medical expenses and any legal fees if they sue.

Additional Living Expenses

Additional living expenses (ALE) coverage helps pay for temporary housing and other extra costs if your home is uninhabitable due to a covered event. This can include hotel bills, restaurant meals, and other living expenses.

Example: If a fire makes your home unlivable, ALE can cover the cost of staying in a hotel and eating out until repairs are completed.

Guest Medical Protection

Guest medical protection covers medical expenses for guests who are injured on your property, regardless of who is at fault. This is a no-fault coverage, meaning it pays out even if the injury was accidental.

Example: If a friend twists their ankle while visiting, guest medical protection can cover their medical bills.

Understanding these coverage types can help you choose the right policy and ensure you’re not caught off guard by unexpected expenses. Next, we’ll explore factors that affect your home insurance rates and how you can save more money.

Factors Affecting Home Insurance Rates

When you buy cheap home insurance, understanding the factors that impact your rates can help you make informed decisions and save money. Let’s explore the key elements that insurers consider when setting your premiums.

Age and Condition

Older homes generally cost more to insure. Why? They might have outdated electrical systems, old plumbing, or roofs that need replacing. These factors increase the risk of damage and, therefore, the cost of insurance.

Example: A house built in 1959 will likely have higher premiums than one built in 2020 due to the potential for wear and tear.

Replacement Cost

Replacement cost is the amount it would take to rebuild your home from scratch. This includes materials and labor. The higher the replacement cost, the higher your premium.

Example: If your home has custom features or high-end finishes, it will cost more to rebuild and, consequently, more to insure.

Location

Where you live significantly affects your home insurance rates. High-risk areas—like those prone to floods, earthquakes, or hurricanes—will have higher premiums.

Example: Homes in Houston, Texas, often have higher rates due to the area’s susceptibility to hurricanes and flooding.

High-Risk Features

Certain features in your home can increase your insurance costs. Swimming pools, trampolines, and wood-burning stoves are considered high-risk because they increase the likelihood of an accident or damage.

Example: A home with a swimming pool could have higher premiums due to the risk of drowning or injury.

Credit History

In many states, your credit score can affect your home insurance rates. Insurers believe that people with higher credit scores are less likely to file claims, so they offer them lower premiums.

Example: A homeowner with excellent credit might pay significantly less for insurance than someone with poor credit.

Dog Breed

Believe it or not, the breed of dog you own can impact your insurance rates. Some breeds are considered high-risk due to their size or temperament, leading to higher premiums.

Example: Owning a breed like a Pit Bull could result in higher insurance costs because they are often perceived as more likely to cause injury.

Understanding these factors can help you take steps to lower your premiums. For instance, improving your credit score or updating an old roof can make a significant difference.

Next, we’ll explore actionable tips on how to buy cheap home insurance and save even more money.

How to Buy Cheap Home Insurance

Ready to save money on your home insurance? Here are some actionable steps to help you buy cheap home insurance without sacrificing coverage.

Compare Rates

The first step is to shop around. Use tools like NuSure to compare rates from multiple insurers.

Why it works: Insurers offer different prices for the same coverage. Comparing rates helps you find the best deal.

Example: One insurer might charge $2,500 per year, while another offers similar coverage for $2,000. That’s a $500 saving!

Raise Your Deductible

Increasing your deductible can lower your premium. A higher deductible means you’ll pay more out-of-pocket if you file a claim, but your monthly premium will be lower.

Why it works: Insurers reward you for taking on more financial responsibility.

Example: Raising your deductible from $1,000 to $2,000 could save you hundreds annually. Just make sure you can afford the higher deductible in case of a claim.

Improve Your Credit

In many states, your credit score affects your home insurance rates. Better credit can mean lower premiums.

Why it works: Insurers see people with higher credit scores as less risky.

Example: Moving from a “poor” to “good” credit tier could lower your annual premium by several hundred dollars.

Make Home Improvements

Upgrading your home can also reduce your insurance costs. Focus on improvements that improve safety and durability.

Why it works: Safer homes are less likely to suffer damage, leading to fewer claims.

Example: Installing a new roof or updating electrical systems can result in lower premiums.

Bundle Policies

Combine your home insurance with other policies like auto or life insurance to get a discount.

Why it works: Insurers offer discounts for bundling, making it one of the easiest ways to save.

Example: Bundling home and auto insurance could save you up to 20% on both policies.

Look for Discounts

Take advantage of available discounts to lower your premium.

Why it works: Discounts reward you for being a low-risk policyholder.

Some common discounts include:

– Home safety: Smoke detectors, security systems, and fire extinguishers.

– Loyalty: Staying with the same insurer for several years.

– Claim-free: Not filing claims over a certain period.

Example: Installing a security system might earn you a 5% discount on your premium.

Shop Annually

Don’t set it and forget it. Review your policy every year to ensure you’re still getting the best rate.

Why it works: Your circumstances change, and so do insurance rates.

Example: If you’ve made home improvements or your credit score has improved, you could qualify for lower rates.

By following these steps, you can find affordable home insurance that meets your needs. Up next, we’ll dive into the top discounts available for cheap home insurance.

Top Discounts for Cheap Home Insurance

Open uping discounts is one of the best ways to buy cheap home insurance. Here are some key discounts you should look for:

Home Safety

Installing safety features can earn you significant discounts.

Why it works: Insurers reward you for reducing risks.

Examples of safety features:

– Smoke detectors

– Security systems

– Fire extinguishers

Example: Installing a monitored security system could reduce your premium by up to 5%.

Homeowners Association (HOA)

If your home is part of a homeowners association, you might qualify for a discount.

Why it works: HOAs often enforce rules that maintain property standards and safety.

Example: Living in an HOA community could earn you a discount just because the area is better maintained and monitored.

Newer Home

The age of your home can also affect your insurance rates. Newer homes often qualify for discounts.

Why it works: Newer homes are built to modern safety standards and are less likely to have issues.

Example: A newly built home might be eligible for a discount of up to 20% compared to an older home.

Wildfire Mitigation

If you live in an area prone to wildfires, taking steps to protect your home can earn you discounts.

Why it works: Wildfire mitigation reduces the risk of significant damage.

Examples of wildfire mitigation:

– Clearing brush around your home

– Installing fire-resistant roofing

Example: Implementing wildfire mitigation measures could save you up to 10% on your premium.

Multi-Policy

Bundling your home insurance with other policies, like auto or life insurance, can result in substantial savings.

Why it works: Insurers offer discounts for multiple policies to encourage customer loyalty.

Example: Bundling home and auto insurance can save you up to 20% on both policies.

By leveraging these discounts, you can significantly reduce your home insurance costs. Up next, we’ll explore best practices for reducing home insurance costs even further.

Best Practices for Reducing Home Insurance Costs

Reducing your home insurance costs doesn’t have to be complicated. Here are some effective strategies:

Deductible Amount

The deductible is the amount you pay out of pocket before your insurance kicks in. Increasing your deductible can lower your premium.

Why it works: Higher deductibles mean less risk for the insurer, so they charge you less.

Example: Raising your deductible from $500 to $1,000 could save you up to 25% on your premium.

Policy Monitoring

Regularly review your insurance policy to ensure you’re not paying for coverage you don’t need.

Why it works: Policies and needs change over time. Keeping your policy updated can help avoid unnecessary costs.

Example: Removing outdated or unnecessary riders can reduce your premium.

Proactive Measures

Taking steps to protect your home can lower your insurance costs.

Why it works: Insurers reward proactive measures that reduce the risk of damage or loss.

Examples of proactive measures:

– Installing a new roof

– Upgrading your electrical system

– Adding storm shutters

Example: A new roof could save you up to 10% on your insurance premium.

Local Agent Consultation

Consulting with a local insurance agent can provide personalized advice and help you find the best rates.

Why it works: Local agents understand the specific risks and insurance needs of your area.

Example: An agent might know about local discounts or state-specific programs that can save you money.

By following these best practices, you can make sure you’re getting the most affordable coverage without compromising on protection. Up next, we’ll dive into frequently asked questions about buying cheap home insurance.

Frequently Asked Questions about Buying Cheap Home Insurance

Who has the cheapest rates on homeowners insurance?

Finding the cheapest rates on homeowners insurance often requires a bit of homework. Some of the most affordable options can be found by comparing rates from multiple top carriers. Prices can vary significantly based on your location, the type of home you own, and your personal circumstances.

Why NUsure? At NUsure, we make it easy to compare rates from multiple top carriers, ensuring you get the best deal. We partner with more than 50 A-rated carriers, so you can find a policy that fits your needs and budget.

Why is home insurance getting so expensive?

Several factors are driving up the cost of home insurance:

Construction Costs: The price of building materials has skyrocketed in recent years. Lumber, steel, and other essential materials have seen significant price increases, making home repairs and rebuilding more expensive.

Labor Shortages: A shortage of skilled labor in the construction industry means higher wages and longer project timelines, both of which contribute to increased insurance premiums.

Extreme Weather: Natural disasters like hurricanes, tornadoes, and wildfires are becoming more frequent and severe. Insurers are adjusting their rates to account for these heightened risks.

How can I shop for cheap homeowners insurance in Texas?

Shopping for cheap homeowners insurance in Texas involves a few key steps:

Understand Local Factors: Texas has its own set of challenges, from tornadoes and hurricanes to extreme heat. Knowing these risks can help you find a policy that offers the right protection at a reasonable price.

Thorough Research: Don’t settle for the first quote you receive. Use tools like NUsure to compare multiple quotes and find the best deal. The average cost of homeowners insurance in Texas is around $2,919 per year, so there’s room for savings if you shop around.

Custom Policy: Tailor your policy to fit your specific needs. For example, if you live in a flood-prone area, you may need additional flood insurance.

Why NUsure? With NUsure, you can complete one form and get matched with quotes from top carriers in your area. This simplifies the process and ensures you find a policy that’s both affordable and comprehensive.

By understanding these factors and using resources like NUsure, you can make informed decisions and find the best, most affordable home insurance policy for your needs.

Conclusion

At NUsure, we’re committed to helping you buy cheap home insurance that doesn’t compromise on coverage. We understand that every homeowner’s needs are unique, which is why we focus on providing personalized policies custom just for you.

Our process is designed to save you both time and money. By completing just one form, you can get matched with quotes from over 50 A-rated carriers. This way, you can easily compare options and find the best deal without the hassle of contacting multiple insurers.

But our service doesn’t stop once you purchase a policy. We offer year-round monitoring to ensure your coverage remains optimal and cost-effective. This proactive approach helps you stay ahead of any changes that could impact your premiums, such as rising construction costs or new discounts you might qualify for.

Choosing NUsure means more than just finding affordable insurance. It means gaining a partner dedicated to protecting your home and your wallet. Start your journey with us today and find how simple and stress-free buying home insurance can be.

Ready to protect your home with a personalized insurance policy? Start your free quote now and experience the NUsure difference.