The Importance of Buying Home Insurance Online

When it comes to buying home insurance online, the process can be surprisingly simple and highly beneficial. Buying home insurance online offers busy homeowners a hassle-free way to get comprehensive coverage without comparing multiple providers.

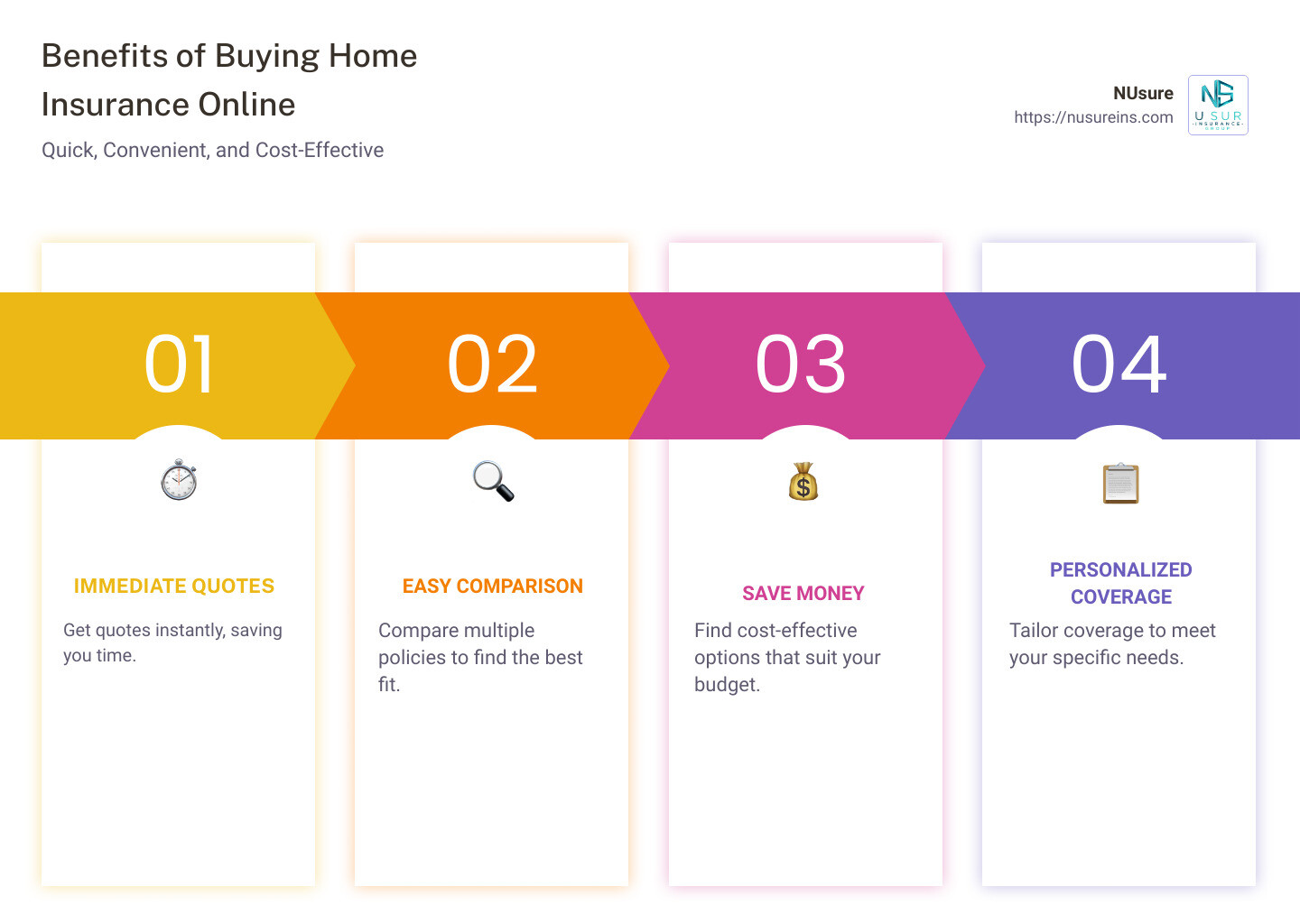

Quick answer:

- Get immediate quotes.

- Easily compare policies.

- Save time and money.

- Secure personalized coverage.

Home insurance is essential for protecting your most valuable assets, including your home, personal belongings, and finances. It covers damages from common perils such as fire, theft, and windstorms, and provides liability coverage if someone is injured on your property.

So, why opt for an online purchase? It’s convenient, cost-effective, and allows you to find the best coverage custom to your needs in just a few clicks.

I’m Michael J. Alvarez, CPRM, CPIA, with experience in property and casualty insurance, specializing in buying home insurance online. I’ve spent years helping homeowners steer the complexities of insurance to find the right coverage effortlessly.

Buy home insurance online terms to know:

Why Buy Home Insurance Online?

Convenience

Imagine sitting on your couch, sipping coffee, and getting all your insurance quotes in minutes. That’s the beauty of buying home insurance online. You no longer need to schedule appointments or visit multiple offices. Everything can be done from your home, at any time that suits you.

Cost Savings

Online platforms often offer lower premiums compared to traditional methods. This is because they cut out the middleman and reduce overhead costs. Plus, you can easily find discounts and special offers that might not be available offline.

Fact: You can save an average of 7% on car insurance when you combine NUsure home and auto policies.

Quick Quotes

Getting a quote online is fast. Most websites only require a few details about your home and personal information. Within minutes, you’ll receive multiple quotes to compare. This speed is best by traditional methods, where you might wait days for a response.

Easy Comparison

One of the biggest advantages of buying home insurance online is the ability to compare multiple policies side-by-side. You can see the differences in coverage, premiums, and additional benefits at a glance. This makes it easier to choose the best policy for your needs.

Example: With NUsure, you can fill out a single form and get matched with quotes from top insurance providers in your area.

Personalized Coverage

Online tools often allow for more customization. You can easily add or remove coverages, adjust limits, and see how these changes affect your premium in real-time. This means you get a policy that fits your specific needs without any unnecessary extras.

Secure Transactions

Buying home insurance online is safe. Reputable companies use secure websites to protect your personal information. Always look for security indicators like HTTPS in the web address and privacy policies before entering your details.

Quote: “It’s never been easier to get affordable and accurate home insurance quotes online. We’ll ask a few simple questions to help you find a policy that best protects your home and family.”

Steps to Buy Home Insurance Online

Ready to buy home insurance online? Follow these simple steps to ensure you get the best coverage for your needs.

Research and Gather Information

Start by gathering all necessary details about your home and personal information. Here’s what you’ll need:

- Home Details: Year built, square footage, construction type, roof type, and any renovations or updates.

- Personal Information: Name, address, contact information, and Social Security number.

- Coverage Needs: Think about what you need covered. This includes dwelling coverage, personal property, liability, and any additional coverages like flood insurance.

Tip: Create a home inventory checklist to document your belongings. This will help you determine the amount of personal property coverage you need.

Compare Quotes from Multiple Insurers

Once you have your information ready, it’s time to compare quotes. Use online tools to get quotes from multiple insurers. Here’s how to do it:

- Visit Insurance Websites: Use platforms like NUsure to fill out a single form and get matched with quotes from top providers.

- Use Quote Comparison Tools: These tools allow you to see multiple quotes side-by-side, making it easier to compare policy features and premiums.

- Check Policy Features: Look beyond the price. Compare the coverage limits, deductibles, and any additional benefits each policy offers.

Example: With NUsure, you can quickly compare quotes and find a policy that fits your budget and coverage needs.

Choose the Right Coverage

Now that you have your quotes, it’s time to choose the right coverage. Here are the key coverages to consider:

- Dwelling Coverage: Covers the cost to repair or rebuild your home if it’s damaged by a covered peril.

- Personal Property: Pays to repair or replace your belongings if they’re stolen or damaged.

- Liability: Protects you if you’re found liable for someone else’s injuries or property damage.

- Additional Coverages: Includes options like flood insurance, earthquake insurance, or coverage for high-value items like jewelry.

Tip: Ensure your dwelling coverage is based on the cost to rebuild your home, not its market value.

Purchase Your Policy

Once you’ve chosen your coverage, it’s time to purchase your policy. Here’s how:

- Complete the Online Purchase: Follow the prompts on the insurer’s website to complete your purchase. This usually involves filling out a final form and providing payment information.

- Secure Payment: Make sure the website is secure (look for HTTPS in the URL) before entering your payment details.

- Immediate Coverage: After purchasing, your coverage typically starts immediately. You’ll receive a policy document via email for your records.

Quote: “It’s never been easier to get affordable and accurate home insurance quotes online. We’ll ask a few simple questions to help you find a policy that best protects your home and family.”

Next, we’ll dive into the Key Coverages in Homeowners Insurance, explaining what each type of coverage entails and why it’s important.

Key Coverages in Homeowners Insurance

When you buy home insurance online, it’s crucial to understand the key coverages in a homeowners insurance policy. These coverages ensure your home and finances are protected from various risks.

Dwelling Coverage

Dwelling coverage is the backbone of your homeowners insurance. It helps pay to repair or rebuild your home if it’s damaged by a covered event, such as fire, wind, or vandalism.

- Repair: If a storm damages your roof, dwelling coverage can help you pay for the repairs.

- Rebuild: In severe cases, like a total loss from a fire, it covers the cost to completely rebuild your home.

Tip: Ensure your dwelling coverage is based on the replacement cost, not the market value of your home. This means it should cover the cost of materials and labor to rebuild your house from scratch.

Personal Property Coverage

Personal property coverage protects your belongings inside your home. This includes items like furniture, electronics, and clothing.

- Furniture: If a fire destroys your living room set, personal property coverage can help replace it.

- Electronics: Coverage can also extend to your gadgets, like TVs and laptops.

- Clothing: Even your wardrobe is covered if it’s damaged or stolen.

Tip: Create a home inventory to document your belongings. This will help you determine the amount of personal property coverage you need.

Liability Coverage

Liability coverage is essential for protecting your finances if you’re found responsible for someone else’s injuries or property damage.

- Legal Fees: If someone sues you after getting injured on your property, liability coverage can help pay for your legal defense.

- Bodily Injury: It covers medical expenses if a guest slips and falls at your home.

- Property Damage: If your child accidentally breaks a neighbor’s window, liability coverage can take care of the repair costs.

Example: Liability coverage can save you from substantial out-of-pocket expenses if you’re sued for an accident that occurs on your property.

Medical Payments Coverage

Medical payments coverage pays for minor medical bills if a guest is injured on your property, regardless of fault.

- Guest Injuries: If a visitor twists their ankle on your stairs, this coverage can help pay for their medical treatment.

- Medical Bills: It covers small medical expenses, preventing potentially larger claims or lawsuits.

Tip: This coverage is usually limited to smaller amounts, but it can prevent larger liability claims.

Additional Living Expenses

Additional living expenses (ALE) coverage helps pay for temporary housing and extra living costs if your home becomes uninhabitable due to a covered loss.

- Temporary Housing: If a fire forces you to move out, ALE can cover the cost of a hotel or rental.

- Living Costs: It also helps with additional expenses like restaurant meals and laundry services while your home is being repaired.

Example: ALE ensures you won’t have to bear the financial burden of living elsewhere while your home is being rebuilt.

Understanding these key coverages will help you make informed decisions when you buy home insurance online. Next, we’ll explore some practical tips for saving on your home insurance policy.

Tips for Saving on Home Insurance

Bundling Policies

One of the easiest ways to save on home insurance is by bundling policies. This means purchasing multiple types of insurance from the same provider. For example, you can bundle your auto and home insurance for a multi-policy discount. Many insurers offer significant savings for this.

Tip: Adding an umbrella insurance policy can also increase your discount. Umbrella insurance provides extra liability coverage, which can be beneficial if you have high-value assets.

Home Safety Devices

Installing home safety devices can lower your insurance premiums. Insurance companies like to see that you’re taking steps to protect your home from potential risks.

- Smoke Detectors: Installing smoke detectors throughout your home can reduce fire risks, which may lower your premium.

- Security Systems: A centrally monitored security system can deter burglars and alert authorities in case of a break-in.

- Water Shut-Off Systems: These systems can prevent extensive water damage by automatically shutting off the water supply if a leak is detected.

Stat: Homes with these safety features often qualify for discounts. For example, having a burglar alarm can lead to a discount on your home insurance.

Higher Deductibles

Choosing a higher deductible can significantly lower your premiums. The deductible is the amount you pay out of pocket before your insurance kicks in.

Tip: Assess your risk tolerance. If you can afford to pay a higher deductible in the event of a claim, you can benefit from lower monthly premiums.

Example: If you raise your deductible from $500 to $1,000, you might see a noticeable drop in your insurance costs.

Available Discounts

Insurance companies offer various discounts that can help you save money on your home insurance policy.

- Early Quote: Getting a homeowners insurance quote before your current policy’s start date can qualify you for an early quote discount.

- Protective Devices: As mentioned, installing protective devices like fire sprinklers or burglar alarms can earn you a discount.

- Loss-Free: If you haven’t filed any claims for a certain period, you may qualify for a loss-free discount.

Example: Many insurers offer an average of 7% savings when you combine home and auto insurance.

Taking advantage of these tips can help you save money when you buy home insurance online. Next, we’ll answer some frequently asked questions about purchasing home insurance online.

Frequently Asked Questions about Buying Home Insurance Online

Is it safe to buy home insurance online?

Yes, buying home insurance online is safe, as long as you use legitimate companies and secure transactions. Reputable insurance companies use advanced encryption technologies to protect your personal and payment information. Look for indicators like HTTPS in the website URL and trust seals from security companies.

Tip: Stick to well-known insurance providers or use trusted comparison platforms like NuSure to ensure you’re dealing with legitimate companies.

What information do I need to get a quote?

To get an accurate homeowners insurance quote, you’ll need to provide detailed information about your home and personal details.

Home Details:

- Home address

- Year the home was built

- Square footage

- Number of rooms, bathrooms, and bedrooms

- Age and condition of the roof

- Heating and cooling system information

- Details about home building materials, like the type of siding used

- Information about any home renovations

Personal Information:

- Your name and contact details

- Mortgage information (if applicable)

Having this information handy will speed up the quote process and ensure you get the most accurate pricing.

How do I know if I have enough coverage?

Ensuring you have enough coverage involves understanding the replacement cost and setting appropriate coverage limits.

Replacement Cost: This is the amount it would cost to rebuild your home from scratch, including materials, labor, and other expenses. It’s different from the market value of your home. Make sure your policy covers 100% of the replacement cost to avoid out-of-pocket expenses.

Coverage Limits: Evaluate the value of your personal belongings and any additional structures on your property. Standard policies cover items like furniture, electronics, and clothing, but you might need extra coverage for high-value items.

Tip: Regularly review and update your policy to reflect any home improvements or significant purchases.

Example: If your home is insured for $250,000 and you have a 2% deductible for wind damage, you would need to pay $5,000 out of pocket before your insurance covers the rest. Check your policy’s declarations page to see these details.

By understanding these aspects, you can confidently buy home insurance online that meets your needs.

Next, we’ll dive into the key coverages included in homeowners insurance.

Conclusion

In summary, buying home insurance online is a smart, convenient way to protect your most significant investment—your home. It offers several benefits, including cost savings, quick quotes, and the ability to compare multiple policies easily. This process ensures you get the best coverage custom to your unique needs.

At NuWe make it simple to find the right policy. By filling out one form, you can receive quotes from top carriers, compare your options, and choose the best coverage—all in minutes.

Benefits of Choosing NuSure:

- Convenience: Get quotes and purchase policies online without stepping out of your home.

- Cost Savings: Compare multiple quotes to find the most affordable option.

- Custom Coverage: Customize your policy to fit your needs and budget.

- Expert Assistance: Our advisors are here to help you every step of the way.

Moreover, our year-round policy monitoring ensures that your coverage remains up-to-date. We keep an eye on any changes in your needs or the market, so you always have the best protection at the best price.

Ready to protect your home with a personalized insurance policy? Start your free quote now and find the NuSure difference today. Get peace of mind knowing your home is protected against the unexpected.

By following these steps, you can confidently buy home insurance online and enjoy the peace of mind that comes with knowing your home and belongings are well-protected.