Why Affordable Home Insurance is Crucial

Cheapest home insurance policy is a phrase that resonates with every homeowner looking to save on essential protections. If you’re in search of the most affordable homeowners insurance, NUsure offers top options tailored to your needs.

Affordable home insurance is crucial. It protects your home and belongings without draining your wallet. Disasters can strike at any time, and having budget-friendly protection ensures you’re covered without financial strain.

At NUsure, we understand the significance of balancing quality and affordability. Our advanced tech and data-driven methods provide customized solutions tailored to your unique needs and budget.

I’m Michael J. Alvarez, CPRM, CPIA, a seasoned expert in property and casualty insurance. With years of experience in markets like Florida and New Jersey, I specialize in finding the cheapest home insurance policy for homeowners without compromising on coverage.

Cheapest home insurance policy word list:

Top 5 Affordable Homeowners Insurance Companies

When searching for the cheapest home insurance policy, it’s essential to compare options from multiple providers. Here are the top five affordable homeowners insurance companies based on recent research:

1. NUsure

NUsure stands out for its ability to match homeowners with personalized quotes from over 50 A-rated carriers. By leveraging advanced technology, NUsure simplifies the insurance shopping process, ensuring you get the best coverage at the most affordable price.

Benefits:

- Access to a vast network of top carriers

- Customized policies custom to your needs

- Quick and efficient online comparison

Finding the cheapest home insurance policy involves comparing rates, considering deductibles, and asking about discounts. By exploring options from these top providers, you can secure the protection you need without breaking the bank.

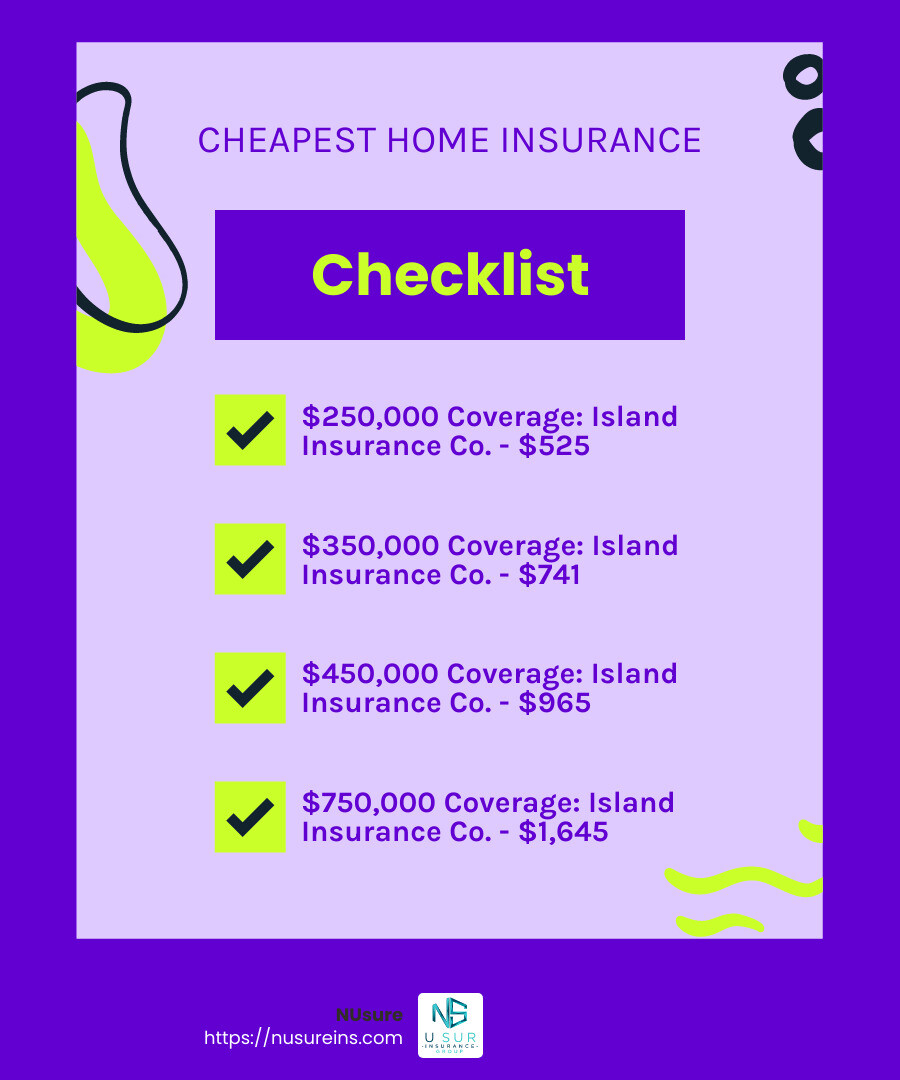

When looking for the cheapest home insurance policy, consider the coverage amount you need. Here’s a breakdown of the most affordable options based on different dwelling amounts:

$250,000 Coverage

For a $250,000 dwelling amount, NUsure offers the most budget-friendly option with an average annual premium of just $525. This is significantly lower than the average of $2,148 across all providers.

$350,000 Coverage

At the $350,000 coverage level, NUsure again leads with an annual premium of $741. Following closely is Auto Owners, with an average premium of $1,697.

$450,000 Coverage

For homes requiring $450,000 in coverage, NUsure continues to offer the lowest rates at $965 per year. Auto Owners also remains a competitive choice with an average premium of $2,060.

$750,000 Coverage

When it comes to higher coverage amounts like $750,000, NUsure is still the most affordable with an annual premium of $1,645. Auto Owners offers a competitive rate of $3,048, making it another excellent option.

$1,000,000 Coverage

For those needing $1,000,000 in coverage, NUsure provides the lowest average premium at $2,204. Auto Owners follows with a rate of $4,351.

When choosing the cheapest home insurance policy, it’s crucial to match your coverage needs with the most affordable options. By selecting a provider like NUsure or Auto Owners, you can secure comprehensive coverage without overspending.

Next, we’ll explore how to find the cheapest home insurance policy by comparing rates, considering deductibles, and choosing endorsements wisely.

How to Find the Cheapest Home Insurance Policy

Finding the cheapest home insurance policy doesn’t have to be difficult. Here are some tips to help you secure the best deal:

Compare Rates

The first step is to compare rates. Use tools like NUsure’s quote comparison to view rates from multiple insurers side-by-side. This way, you can find the most affordable options custom to your needs.

Tip: Even if you already have a policy, comparing rates annually can help you find potential savings.

Consider Deductibles

Your deductible is the amount you pay out of pocket before insurance kicks in. A higher deductible usually means a lower premium. For example, increasing your deductible from $500 to $1,000 can significantly reduce your monthly payments.

Note: Make sure you’re comfortable with the higher out-of-pocket cost in case of a claim.

Choose Endorsements Wisely

Endorsements, or policy add-ons, can expand your coverage but also increase your premium. Only choose endorsements that are necessary for your situation. For example, earthquake coverage may be essential in California but not in Nebraska.

Ask About Discounts

Many insurers offer discounts for various reasons. You can save by:

- Bundling home and auto insurance

- Installing safety features like smoke detectors and burglar alarms

- Paying your policy in full

- Quoting in advance and receiving documents by email

Did you know? Bundling home and auto insurance can save you over 20% on average.

Replacement Cost vs. Actual Cash Value

Understand the difference between replacement cost and actual cash value.

- Replacement cost covers the cost to rebuild or repair your home with new materials.

- Actual cash value takes depreciation into account, meaning you get less money.

Choosing actual cash value can lower your premiums but may not fully cover the cost of repairs or replacements.

By following these steps, you’ll be well on your way to finding the cheapest home insurance policy that fits your needs and budget. Next, let’s look at how your location can impact your premiums and which providers offer the best rates in different areas.

Cheapest Homeowners Insurance by Location

Your location plays a big role in determining your home insurance premiums. Different states and cities have unique risks and costs associated with them, impacting how much you pay for coverage.

State-Specific Providers

Some insurance providers offer better rates in specific states. For example, certain providers may offer the cheapest home insurance in various states due to differing risks like natural disasters or crime rates.

Example: Nebraska has the most expensive home insurance, averaging $6,605 per year. In contrast, Hawaii offers the lowest average annual premium at $733.

City-Specific Providers

Even within a state, your city can affect your home insurance rates. Providers may offer different premiums based on local risks and costs of living.

Fact: Insurers consider your home’s distance from a fire department. A shorter distance can mean lower premiums due to quicker response times and reduced potential damage.

Impact of Location on Premiums

Here are some factors related to your location that can impact your home insurance premiums:

- Fire Zones: If your home is in a fire-prone area, expect higher premiums.

- Brush Fire Areas: Similar to fire zones, living in a brush fire area can increase your insurance costs.

- Cost of Living: Higher local costs can raise your premiums because labor and material costs for repairs are more expensive.

- Local Crime Rates: Areas with higher crime rates may have higher premiums due to increased risk of theft and vandalism.

Tip: Always check the specific risks associated with your location when shopping for the cheapest home insurance policy. Use tools like NUsure’s quote comparison to get rates custom to your exact address.

By understanding how your location affects your premiums, you can better steer the insurance market and find the most affordable coverage for your home. Next, we’ll dig into other factors that affect your home insurance premiums.

Factors Affecting Home Insurance Premiums

When determining your home insurance premiums, several factors come into play. Understanding these can help you find the cheapest home insurance policy that fits your needs.

Dwelling Coverage Limit

The dwelling coverage limit is the maximum amount your insurance will pay to rebuild your home if it’s damaged. Higher limits mean more protection but also higher premiums.

Example: If you have a home valued at $450,000, your insurance premium will be higher compared to a home valued at $250,000. NUsure offers competitive premiums for a $450,000 dwelling coverage.

Claims History

Your claims history can significantly impact your premium. If you’ve filed multiple claims, insurers may see you as a higher risk, leading to higher premiums.

Fact: Filing multiple claims can even result in your policy being denied at renewal. NUsure offers affordable premiums for those with a recent claim on record.

Credit Score

Your credit score can also affect your home insurance rates. Insurers often use credit-based insurance scores to predict the likelihood of future claims.

Statistics: Poor credit can increase your premiums by 50% to 100%. States like California and Maryland prohibit the use of credit scores in calculating premiums, but in other states, a good credit score can save you a lot.

Bundling Policies

Bundling policies can save you money. Many insurers offer discounts if you purchase both home and auto insurance from them.

Example: New customers who bundle homeowners and auto insurance with NUsure save significantly on average.

By understanding these factors, you can make informed decisions and find the most affordable home insurance policy that meets your needs. Next, we’ll answer some frequently asked questions about the cheapest home insurance policy.

Frequently Asked Questions about the Cheapest Home Insurance Policy

What is the cheapest homeowners insurance?

The cheapest homeowners insurance isn’t one-size-fits-all. It depends on various factors like your home’s location, the coverage amount, and your personal circumstances. However, some companies consistently offer lower premiums across different states and situations.

For example, NUsure often ranks as the cheapest provider, offering competitive rates and excellent customer service. For non-military households, NUsure is known for its affordable premiums and comprehensive coverage options.

Fact: According to our research, NUsure offers the lowest average annual premium for $300,000 dwelling coverage at $986.

Who typically has the cheapest insurance?

The cheapest insurance providers vary by state and individual circumstances. However, some companies frequently offer the best rates:

- NUsure: Known for competitive rates and excellent bundling discounts.

Example: In New Jersey, NUsure offers the cheapest average annual premium at $966 for $300,000 dwelling coverage.

What is the cheapest homeowners insurance for seniors?

Seniors often benefit from additional discounts and specialized policies. Companies like NUsure offer senior-specific discounts, making them attractive options.

Statistics: NUsure provides up to 25% savings when seniors bundle home and auto insurance, offering a 20% discount for the same.

By comparing rates, asking about discounts, and considering your specific needs, you can find the cheapest homeowners insurance policy that works best for you.

Conclusion

Finding the cheapest home insurance policy can be a game-changer for your finances. By understanding the factors that affect premiums and knowing where to look, you can secure the best coverage without breaking the bank.

Why Choose NuSure?

At NuWe simplify the insurance shopping process. With just one form, you get matched with quotes from top carriers. This means you can quickly compare options and find a policy custom to your unique needs and budget.

How NuSure Helps

- Personalized Quotes: We provide quotes from over 50 A-rated carriers, ensuring you get the best rates.

- Easy Comparison: No more spending hours researching. Compare options in minutes.

- Smooth Process: Once you choose a policy, you can complete your purchase online or over the phone with our advisors.

Ready to Save?

Affordable home insurance is just a few clicks away. Start your free quote now and find the NuSure difference today. Protect your home and enjoy peace of mind knowing you’re covered against the unexpected.

By comparing rates and leveraging discounts, you can find the cheapest home insurance policy that fits your needs. Don’t wait—secure your financial future with the right coverage today.