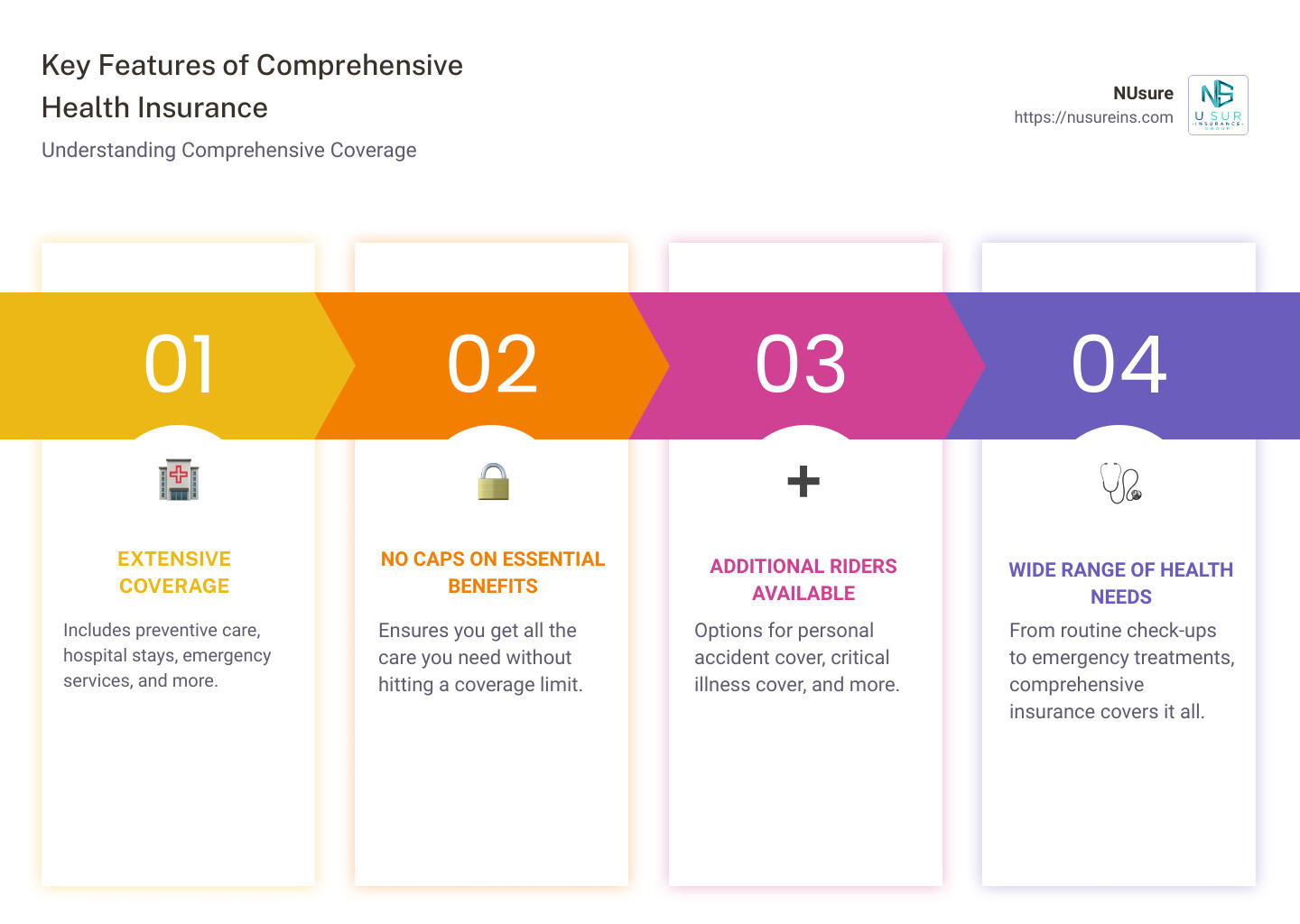

Comprehensive health insurance coverage meaning is essential for understanding how this type of insurance can impact both your health and financial well-being. Put simply, comprehensive health insurance provides extensive coverage, protecting you against a wide range of medical costs. Here’s a quick overview:

- Extensive Coverage: Includes preventive care, hospital stays, emergency services, and more.

- No Caps on Essential Health Benefits: Ensures you get all the care you need without hitting a coverage limit.

- Additional Riders Available: Options for personal accident cover, critical illness cover, and more.

Comprehensive health insurance is important because it covers a broad spectrum of health needs, from routine check-ups to emergency treatments. It can prevent you from facing catastrophic medical bills and ensures you have access to necessary healthcare without the stress of out-of-pocket expenses.

I am Michael J. Alvarez, CPRM, CPIA, a seasoned expert in health insurance. With years of experience in creating and managing insurance policies, my aim is to help you steer the complexities of comprehensive health insurance coverage meaning with ease.

What is Comprehensive Health Insurance?

Comprehensive health insurance is a type of health insurance that offers broad coverage for a wide range of medical services. This includes everything from routine check-ups to emergency treatments. It’s designed to protect you from high medical costs by covering a variety of healthcare needs.

Major Medical Insurance

Major medical insurance is another term often used to describe comprehensive health insurance. This type of insurance covers most medical services and procedures you might need in a year. Some examples include:

- Preventive care: Regular screenings, check-ups, and vaccinations

- Hospital care: Inpatient stays, surgeries, and hospital services

- Emergency services: Trips to the emergency room for urgent care

- Prescription medication: Coverage for necessary prescription drugs

- Mental health services: Counseling, therapy, and medication for mental health issues

ACA-Compliant Plans

Since the introduction of the Affordable Care Act (ACA) in 2014, all new individual/family and small-group major medical policies must cover ten essential health benefits with no annual or lifetime benefit caps. These benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services

ACA-compliant plans ensure you get comprehensive coverage, safeguarding you from high medical costs and providing access to necessary healthcare services.

Why Comprehensive Health Insurance Matters

Comprehensive health insurance is crucial for several reasons:

- Financial Protection: Shields you from high medical costs.

- Access to Care: Ensures you can get the medical treatments you need.

- Peace of Mind: Reduces stress about medical expenses.

In summary, comprehensive health insurance provides extensive coverage, protecting you from a wide range of medical costs and ensuring you have access to necessary healthcare services without the stress of out-of-pocket expenses.

Key Features of Comprehensive Health Insurance

Comprehensive health insurance covers a wide range of medical services. Here are the key features you can expect:

Preventive Care

Preventive care is crucial for maintaining good health and catching potential issues early. Comprehensive health plans typically cover:

- Regular screenings: These include checks for blood pressure, cholesterol, and cancer.

- Annual check-ups: Routine visits to your primary care physician to monitor your overall health.

- Vaccinations: Immunizations for diseases like the flu, measles, and COVID-19.

Preventive care helps you stay healthy and avoid more serious health issues in the future.

Hospitalization

Hospital stays can be very expensive. Comprehensive health insurance covers:

- Inpatient services: Costs for room and board, nursing care, and other hospital services.

- Surgical procedures: Expenses related to surgery, including the surgeon’s fees and anesthesia.

- Post-operative care: Follow-up visits and treatments after surgery.

Hospitalization coverage ensures that you can receive necessary care without worrying about the costs.

Emergency Services

Emergencies can happen anytime, and they often come with high medical bills. With comprehensive health insurance, you get:

- Emergency room visits: Coverage for trips to the ER for urgent medical issues.

- Ambulance services: Costs for transportation to the hospital in an emergency.

- Urgent care: Visits to urgent care centers for immediate but non-life-threatening issues.

Emergency services coverage provides peace of mind, knowing you’re protected in urgent situations.

Prescription Medication

Medications can be a significant part of your healthcare costs. Comprehensive plans typically cover:

- Prescription drugs: A portion or all of the cost for medications prescribed by your doctor.

- Specialty drugs: Coverage for high-cost medications used to treat complex conditions.

- Generic drugs: Often covered at a lower copay, making them more affordable.

Prescription medication coverage ensures you can afford the drugs you need to manage your health.

Mental Health Services

Mental health is just as important as physical health. Comprehensive health insurance includes:

- Counseling and therapy: Sessions with licensed mental health professionals.

- Psychiatric services: Visits to psychiatrists for medication management and other treatments.

- Rehabilitation programs: Support for substance use disorders and other mental health issues.

Mental health coverage ensures you have access to the care you need to maintain your overall well-being.

Maternity Care

Starting or growing a family involves significant healthcare needs. Comprehensive health insurance covers:

- Prenatal care: Regular check-ups and tests during pregnancy to monitor the health of the mother and baby.

- Labor and delivery: Costs associated with childbirth, whether vaginal or cesarean.

- Postnatal care: Follow-up visits and treatments for both mother and baby after birth.

Maternity care coverage ensures you and your baby receive the best possible care throughout pregnancy and delivery.

By understanding these key features, you can see how comprehensive health insurance provides broad coverage, protecting you from a wide range of medical costs and ensuring you have access to necessary healthcare services without the stress of out-of-pocket expenses.

Comprehensive Health Insurance Coverage Meaning

When we talk about comprehensive health insurance coverage, we mean a plan that provides broad protection against a wide array of healthcare costs. This type of insurance is designed to cover many different services and treatments, ensuring you have access to the care you need without worrying about high out-of-pocket expenses.

Broad Coverage

Comprehensive health insurance plans are known for their extensive coverage. They typically include:

- Preventive care: Regular screenings, annual check-ups, and vaccinations to help catch health issues early.

- Hospitalization: Inpatient services, surgical procedures, and post-operative care.

- Emergency services: Emergency room visits, ambulance services, and urgent care.

- Prescription medication: Coverage for both generic and specialty drugs.

- Mental health services: Counseling, therapy, psychiatric services, and rehabilitation programs.

- Maternity care: Prenatal, labor and delivery, and postnatal care.

This broad coverage ensures that most of your healthcare needs are met, reducing the financial burden of medical expenses.

Essential Health Benefits

One of the key elements of comprehensive health insurance is its inclusion of essential health benefits. According to the Affordable Care Act (ACA), all ACA-compliant plans must cover ten essential health benefits, which include:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

These benefits are designed to cover the most critical aspects of healthcare, ensuring you get the necessary treatments and services.

No Benefit Caps

Another important feature of comprehensive health insurance is the absence of benefit caps. Before the ACA, many health plans had annual or lifetime limits on how much they would pay for your care. This meant that if you had a serious illness or injury, you could quickly reach these caps and be left to cover the remaining costs yourself.

With comprehensive health insurance, there are no annual or lifetime benefit caps. This means your insurance will continue to pay for covered services no matter how high your medical costs go, providing you with peace of mind and financial protection.

In summary, comprehensive health insurance coverage means having a plan that offers broad protection, includes essential health benefits, and has no benefit caps. This type of insurance ensures you can access necessary healthcare services without the stress of high out-of-pocket expenses.

Next, let’s explore the different types of comprehensive health insurance plans available.

Types of Comprehensive Health Insurance Plans

When it comes to comprehensive health insurance coverage, there are several types of plans available to suit different needs. Let’s break down the main types: employer-sponsored plans, ACA-compliant marketplace plans, Medicaid, and Medicare.

Employer-Sponsored Plans

Employer-sponsored plans are one of the most common types of comprehensive health insurance. These plans are offered by employers to their employees as part of a benefits package.

- Coverage: Typically, these plans cover a wide range of services, including preventive care, hospitalization, emergency services, prescription medications, and mental health services.

- Cost: Employers usually pay a significant portion of the premium, making it more affordable for employees. According to the Kaiser Family Foundation, employees paid an average of $1,327 per year for their health insurance in 2022, while employers covered the rest.

- Benefits: These plans often include additional benefits such as wellness programs, dental, and vision coverage.

ACA-Compliant Marketplace Plans

ACA-compliant marketplace plans are available through federal and state health insurance exchanges. These plans are designed to meet the requirements set by the Affordable Care Act (ACA).

- Coverage: ACA plans must cover the ten essential health benefits, such as ambulatory services, emergency care, hospitalization, maternity and newborn care, mental health services, prescription drugs, and more.

- Cost: Premiums can be offset by subsidies and tax credits based on your income and household size. This makes ACA plans a viable option for those who do not have access to employer-sponsored insurance.

- Enrollment: You can enroll in an ACA plan during the annual open enrollment period or qualify for a special enrollment period due to life events like marriage, birth, or job loss.

Medicaid

Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families.

- Coverage: Medicaid covers a broad range of services, including hospital care, physician services, laboratory and X-ray services, and home health care. Some states also offer additional benefits like dental and vision care.

- Eligibility: Eligibility criteria vary by state but generally include income level, family size, and sometimes disability status.

- Cost: Medicaid is either free or has very low out-of-pocket costs, making it accessible for those with limited financial resources.

Medicare

Medicare is a federal program that primarily covers individuals aged 65 and older, but also some younger people with disabilities.

- Coverage: Medicare is divided into parts:

- Part A: Covers hospital stays, skilled nursing facility care, and some home health care.

- Part B: Covers outpatient care, doctor visits, and preventive services.

- Part C (Medicare Advantage): Offered by private insurers, these plans provide all Part A and B benefits and often include additional services like dental, vision, and prescription drugs.

- Part D: Covers prescription drugs.

- Cost: While Part A is usually premium-free, Parts B, C, and D require premiums. Medicare Advantage plans often have lower out-of-pocket costs compared to Original Medicare.

Each of these types of comprehensive health insurance plans offers extensive coverage, but the best option depends on your specific needs, eligibility, and financial situation.

Next, let’s discuss the benefits of choosing comprehensive health insurance.

Benefits of Comprehensive Health Insurance

Choosing comprehensive health insurance brings several advantages. Let’s break down some key benefits:

Extensive Coverage

Comprehensive health insurance covers a wide range of medical expenses. This includes hospitalization, pre-and post-hospitalization costs, daycare procedures, and even treatments under AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy). For example, NUsure’s health plans offer extensive protection, including maternity and dental cover.

Outpatient Treatment

Unlike basic health insurance, comprehensive plans cover outpatient (OPD) treatments. This means you can claim expenses for doctor consultations, diagnostics, and minor procedures without needing hospitalization. This feature is particularly beneficial as it covers everyday healthcare needs.

Cumulative Bonus

A cumulative bonus is a reward for not making any claims during a policy year. Instead of getting a discount on the renewal premium, your sum insured increases. For instance, if you have a claim-free year, the insurer may increase your coverage by a certain percentage without extra cost.

Lifetime Renewability

The best comprehensive health insurance plans offer lifetime renewability. This means there’s no age limit for renewing your policy. As long as you pay your premiums on time, you can continue enjoying your health coverage indefinitely.

Family Coverage

Comprehensive health insurance often comes with family-floater options. You can cover your spouse, children, and dependent parents under a single policy. Some plans even extend coverage to in-laws and siblings. This ensures that your entire family is protected under one plan.

Cashless Treatment

Comprehensive plans offer cashless treatment options. This means you don’t have to pay upfront for medical expenses at network hospitals. The insurer settles the bill directly with the hospital. For example, NUsure has partnered with numerous network hospitals to provide hassle-free cashless treatment.

These benefits make comprehensive health insurance a valuable investment for securing your and your family’s health and financial well-being.

Next, let’s look at the cost aspects of comprehensive health insurance.

Cost of Comprehensive Health Insurance

Understanding the cost of comprehensive health insurance is crucial. This section will explain premiums, cost-sharing, subsidies, and deductibles.

Premiums

Premiums are the monthly fees you pay for your health insurance. Think of it as the membership fee to keep your coverage active. According to the Kaiser Family Foundation (KFF), in 2020, the average premium for employer-provided coverage for a single employee was $7,470 annually. Out of this, workers paid about $1,243, while employers covered the rest.

For marketplace plans, premiums vary by metal rating. In 2021, the average monthly premiums were:

- Bronze plans: $328

- Silver plans: $470

- Gold plans: $501

These amounts are before any subsidies reduce the cost.

Cost-Sharing

Cost-sharing refers to the portion of medical expenses you cover out-of-pocket. This includes:

- Deductibles: The amount you pay before your insurance starts covering costs. For employer-provided plans, the average deductible in 2020 was $1,644. For marketplace plans in 2021, average deductibles were $6,921 for Bronze plans, $4,816 for Silver plans, and $1,641 for Gold plans.

- Copayments: Fixed amounts you pay for specific services, like $20 for a doctor’s visit.

- Coinsurance: A percentage of costs you pay after meeting your deductible. For example, you might pay 20% of the cost of a service, while your insurance covers 80%.

Subsidies

Subsidies can significantly reduce your premium costs. In 2021, 86% of marketplace enrollees received subsidies. Before the American Rescue Plan (ARP), the average subsidy was $486 per month, lowering the average premium from $575 to $104. With ARP improvements, the average after-subsidy premium dropped to $62 per month.

Deductibles

As mentioned, deductibles are the amounts you pay before your insurance kicks in. Higher deductibles usually mean lower premiums and vice versa. For example, Bronze plans have higher deductibles but lower premiums, while Gold plans have lower deductibles but higher premiums.

Understanding these cost elements can help you choose the right comprehensive health insurance plan for your needs and budget.

Next, let’s answer some common questions about comprehensive health insurance coverage.

Frequently Asked Questions about Comprehensive Health Insurance Coverage Meaning

What is considered a comprehensive health policy?

A comprehensive health policy is an all-inclusive plan that covers a wide range of healthcare services. It typically includes essential health benefits like:

- Preventive care: Regular check-ups, vaccinations, and screenings.

- Hospitalization: Costs for staying in a hospital, including room rent and surgery.

- Emergency services: Ambulance and emergency room visits.

- Prescription medication: Costs for prescribed drugs.

- Mental health services: Therapy, counseling, and psychiatric care.

- Maternity care: Prenatal, delivery, and postnatal care.

These policies provide extensive coverage, ensuring you are protected against high medical expenses for various treatments and services.

What is the difference between comprehensive and non-comprehensive health insurance?

The key difference lies in the scope of coverage:

- Comprehensive health insurance covers a broad range of medical services, including preventive care, hospitalization, emergency services, prescription drugs, and more. It often includes additional benefits like outpatient treatment and mental health services.

- Non-comprehensive health insurance offers limited coverage. It might only cover specific illnesses or treatments, often excluding preventive care and outpatient services. These plans usually have lower premiums but higher out-of-pocket costs when you need medical care.

Example: A comprehensive plan might cover both your annual check-up and an unexpected surgery, whereas a non-comprehensive plan might only cover the surgery.

Why is having a comprehensive health insurance plan important?

Having a comprehensive health insurance plan is crucial for several reasons:

- Extensive Coverage: It covers a wide range of medical services, ensuring you get the care you need without worrying about high costs.

- Financial Protection: With rising medical costs, a comprehensive plan protects your savings by covering significant portions of your medical expenses.

- Access to Quality Care: These plans often include access to a network of top healthcare providers, ensuring you receive quality care.

- Peace of Mind: Knowing that you and your family are protected against various health issues allows you to focus on recovery rather than financial stress.

For instance, during the COVID-19 pandemic, comprehensive plans covered the cost of vaccines with zero cost-sharing, providing essential protection without additional financial burden.

Next, let’s explore the different types of comprehensive health insurance plans available.

Conclusion

At NUsure, we understand that navigating health insurance can be overwhelming. That’s why we aim to make it simple and personalized for you.

Personalized Policies: We believe that your health needs are unique. Our goal is to match you with a health insurance plan that fits your specific requirements and budget. Whether you need extensive coverage for a growing family or a plan that focuses on preventive care, we have options custom just for you.

Year-Round Monitoring: Your health needs can change over time, and so can your insurance requirements. We offer year-round monitoring to ensure your policy continues to meet your needs. Our team is always available to help you adjust your coverage as your life circumstances evolve.

Choosing the right health insurance plan is crucial for your peace of mind and financial security. With NUsure, you can rest assured that you’re getting comprehensive coverage that protects you and your loved ones against unexpected medical expenses.

Feel free to explore our health insurance options and find the best plan for you.

Thank you for trusting NUsure with your health insurance needs.

For more information on our services, visit our Health Insurance page.