Get the Best Deals with Free Insurance Comparison

When it comes to finding the right insurance for your car, using a free insurance comparison tool can be a game-changer. Whether you’re purchasing a new car or just seeking a new insurance provider, comparing quotes is essential to ensure you’re getting the best value for your money.

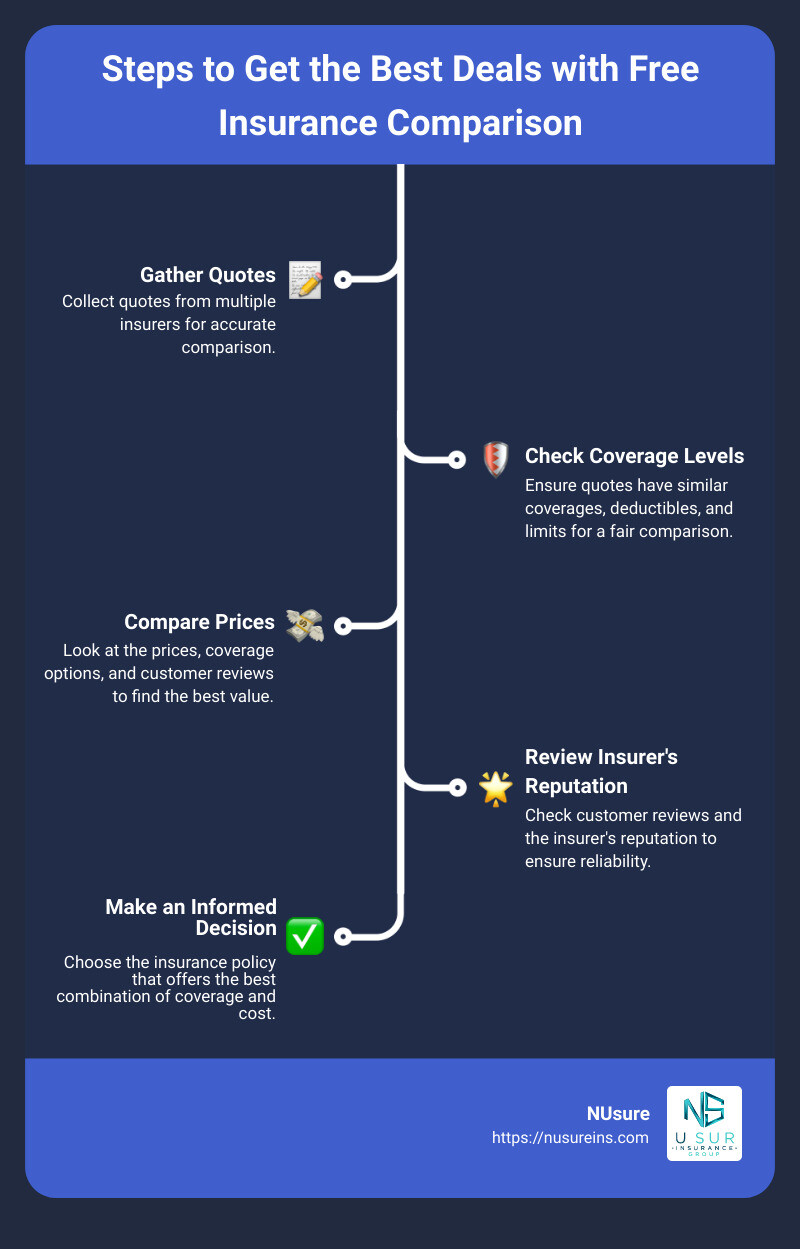

To make a quick decision, here’s what you need to know:

- Gather quotes from multiple insurers.

- Ensure quotes have similar coverages, deductibles, and limits.

- Compare prices, coverage options, and reviews.

Comparing insurance quotes is crucial because it helps you understand your coverage options and save money by identifying the best value. A well-informed comparison can make the process simple, and finding the right policy doesn’t have to be time-consuming or stressful.

As Michael J. Alvarez, CPRM, CPIA, I bring years of experience in helping clients steer insurance options to find the perfect fit. My expertise ensures that you can leverage a free insurance comparison to secure the most comprehensive and affordable coverage.

By comparing insurance quotes, we can ensure you receive the best coverage custom to your needs, saving you both time and money. Next, we’ll explore why comparing insurance quotes is so important.

Why Compare Insurance Quotes?

Comparing insurance quotes is a critical step in finding the best coverage for your vehicle. Let’s explore why it’s so important and how it can benefit you.

Importance of Comparison

Insurance rates can vary significantly between providers. By comparing quotes, you can see the differences in pricing and coverage options. This process helps ensure you’re not overpaying for your policy.

Example: Imagine two providers offer similar coverage, but one charges $100 more per month. Without comparison, you might end up paying an extra $1,200 a year for the same protection.

Multiple Insurers

When shopping for insurance, get quotes from multiple insurers. Each company uses different criteria to calculate premiums, so the cost for the same coverage can differ widely.

Fact: According to the Insurance Information Institute, consumers should compare at least three quotes to get a good sense of the market.

Personalized Quotes

Personalized quotes are custom to your specific situation. Factors like your driving history, vehicle type, and location all influence the cost of your policy. By providing accurate information, you can get quotes that reflect what you’ll actually pay.

Quote: “A car insurance quote is an estimate of what your rates could be based on the information you supply.”

Best Value

The goal of comparing insurance quotes is to find the best value. This doesn’t always mean the cheapest policy, but rather the one that offers the most comprehensive coverage for the price.

Statistic: Among home insurance companies analyzed, average rates increase by 32% on average from $350,000 to $500,000 in dwelling coverage. This shows how much prices can vary based on coverage amounts.

By taking the time to compare quotes, you can ensure you’re getting the best possible deal. This way, you can protect your vehicle and your wallet.

Next, we’ll explore how to compare insurance quotes effectively to make sure you’re getting the most accurate and beneficial information.

How to Compare Insurance Quotes Effectively

Step 1: Decide on Auto Insurance Coverages

When comparing insurance quotes, start by deciding on the coverages you need. Not all policies are created equal, so understanding the different types of coverage is crucial.

- Comprehensive Coverage: Covers losses from incidents other than collisions, such as theft or natural disasters.

- Collision Coverage: Pays for damage to your car from collisions with other vehicles or objects.

- Uninsured Motorist Coverage: Helps cover your injuries if the other driver doesn’t have insurance.

- Underinsured Motorist Coverage: Protects you if the at-fault driver’s insurance isn’t enough to cover your injuries.

- Medical Payments Coverage: Pays for medical expenses related to an accident.

- Personal Injury Protection (PIP): Covers medical treatment, lost wages, and other accident-related expenses.

Using a coverage calculator can help you understand these terms and decide what you need.

Step 2: Choose Deductibles

A deductible is the amount you pay out of pocket before your insurance kicks in. Choosing the right deductible can affect your premium.

- Definition: The out-of-pocket amount you pay for a claim.

- Impact on Premium: Higher deductibles usually mean lower premiums, and vice versa.

- Consistency: Ensure that the deductible amount is the same across all quotes for an accurate comparison.

Step 3: Review and Compare Liability Limits

Liability coverage is required in most states and is crucial for protecting you financially if you’re at fault in an accident.

- State Requirements: Each state has minimum liability coverage requirements. Check your state’s regulations to ensure compliance.

- Bodily Injury Liability: Covers medical expenses for injuries you cause to others.

- Property Damage Liability: Pays for damage you cause to another person’s property.

Example limits are often shown as 100/300/50:

– 100: $100,000 per person in bodily injury liability

– 300: $300,000 per accident in bodily injury liability

– 50: $50,000 per accident in property damage liability

Gathering Quotes

To effectively compare insurance quotes, gather quotes from multiple insurers. Make sure you’re comparing similar coverage levels, deductibles, and limits.

- Price: Look at the cost of each policy.

- Coverage Options: Check what each policy covers.

- Customer Reviews: Read reviews to gauge customer satisfaction.

- Insurer’s Reputation: Consider the reputation of the insurance company.

By following these steps, you can ensure you’re comparing apples to apples and finding the best policy for your needs.

Next, we’ll discuss the benefits of using free insurance comparison tools to streamline this process.

Free Insurance Comparison Tools

Benefits of Using Free Insurance Comparison Tools

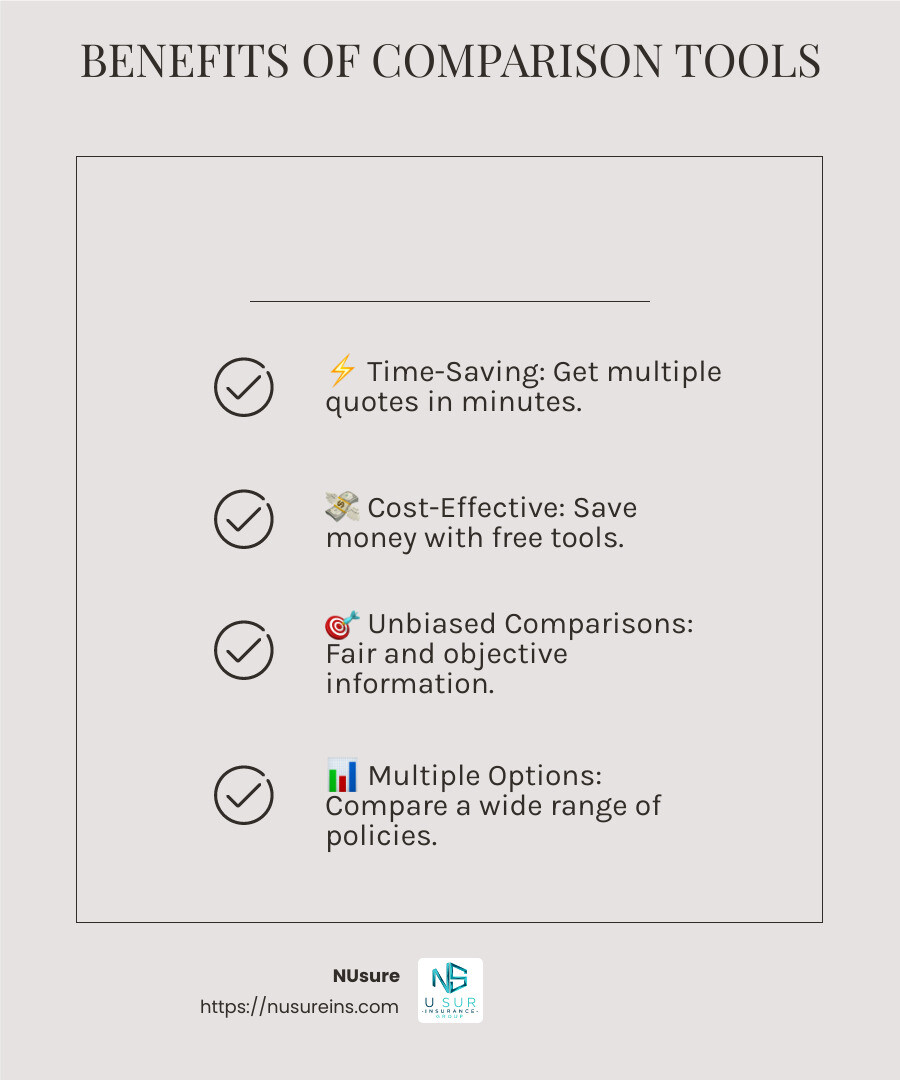

Using free insurance comparison tools can make finding the best deals on auto insurance a breeze. Here’s why these tools are so valuable:

Time-Saving

Gone are the days of calling multiple insurance agents or visiting different websites to get quotes. With free comparison tools, you can get multiple quotes in minutes. These tools gather information from various insurers and present it to you in one place, saving you a ton of time.

Cost-Effective

Comparing quotes helps you find the most affordable insurance that meets your needs. Since these tools are free, you don’t have to pay anything to see what different insurers offer. This means more money in your pocket.

Unbiased Comparisons

Free insurance comparison tools are designed to provide unbiased information. They don’t favor one insurer over another, ensuring you get a fair comparison of rates and coverage options. This helps you make an informed decision based on your needs, not on a sales pitch.

Multiple Options

These tools pull quotes from numerous insurers, giving you a wide range of options. Whether you’re looking for basic liability coverage or comprehensive insurance, you can compare different policies side by side. This makes it easier to find a plan that fits your budget and coverage needs.

Personalized Quotes

When you use a free insurance comparison tool, you enter your specific information, such as your vehicle details and driving history. The tool then provides quotes custom to your situation. Personalized quotes mean you’re comparing policies that are relevant to you, not generic estimates.

Easy Process

The process is straightforward. Most tools only require you to fill out a single form with your details. Then, the tool does the heavy lifting, fetching quotes from multiple insurers. You can review and compare these quotes at your convenience.

Using these tools, like those offered by NUsure, simplifies the insurance shopping process and ensures you get the best deal possible.

Next, we’ll cover some top tips for getting accurate insurance quotes.

Top Tips for Getting Accurate Insurance Quotes

Common Mistakes to Avoid

When comparing insurance quotes, accuracy is key. Here are some tips to ensure you get the most precise quotes possible, and common mistakes to avoid:

1. Provide Accurate Information

- Driver’s License: Ensure you have your driver’s license number handy. This helps insurers pull up your driving record and offer accurate quotes.

- VIN (Vehicle Identification Number): The VIN provides specific details about your car. Without it, you might get a generic quote that doesn’t reflect your vehicle’s true risk profile.

- Driving History: Be honest about your driving history. Insurers will verify this information, and any discrepancies can lead to inaccurate quotes or even policy cancellations.

- Vehicle Storage Address: Where you park your car overnight matters. Rates can vary significantly based on your location due to factors like crime rates and traffic density.

2. Avoid Incomplete Information

Incomplete information can lead to inaccurate quotes. Make sure you fill out all fields when using a comparison tool. Missing details can skew the results and leave you with an unreliable estimate.

3. Double-Check Your Driving History

Mistakes in your driving history can affect your quotes. Ensure you report any tickets, accidents, or violations accurately. Insurers will check this against official records, so accuracy is crucial.

4. Don’t Forget the VIN

Leaving out your VIN can lead to a generic quote that doesn’t account for your car’s specific features and risk factors. Always include this information for the most precise estimate.

5. Be Clear About Coverage Details

Specify the type of coverage you need. Whether it’s liability, comprehensive, or collision, different coverages come with different costs. Make sure you’re comparing similar policies to get an accurate sense of the best deal.

6. Consistent Deductibles

When comparing quotes, keep deductibles consistent. A higher deductible can lower your premium, but it also means more out-of-pocket in case of an accident. Comparing policies with the same deductibles ensures you’re making an apples-to-apples comparison.

By following these tips and avoiding common mistakes, you can ensure that the quotes you receive are accurate and reflective of your specific needs. This makes it easier to find the best deal and the right coverage for you.

Next, we’ll answer some frequently asked questions about free insurance comparison.

Frequently Asked Questions about Free Insurance Comparison

What do you need to compare car insurance quotes online?

To get accurate car insurance quotes online, you’ll need to provide specific information:

- Driver’s License: Insurers use your driver’s license number to access your driving record. This helps them offer precise quotes based on your driving history.

- Driving History: Be honest about any tickets, accidents, or violations in the past five years. Insurers verify this information, so accuracy is crucial.

- Vehicle Identification Number (VIN): The VIN gives insurers detailed information about your car, including its make, model, and features. This ensures the quote reflects your vehicle’s risk profile.

- Vehicle Storage Address: Your car’s overnight parking location affects your rates. Insurers consider factors like crime rates and traffic density in your area.

Why is it important to compare auto insurance quotes?

Comparing auto insurance quotes is essential for several reasons:

- Different Pricing Approaches: Each insurer has its own method for calculating premiums. A company that’s cheap for one person might be expensive for another. By comparing quotes, you can find the best price for your specific situation.

- Discounts: Different insurers offer various discounts. For example, some might give discounts for bundling policies, having a clean driving record, or even for being a good student.

- Best Coverage and Price Decision: Comparing quotes helps you balance cost and coverage. You can evaluate which insurer offers the most comprehensive coverage at a price that fits your budget.

Does a low car insurance rate mean you’ll get the best coverage?

Not necessarily. A low rate might seem attractive, but it’s important to look at the details:

- Consistent Coverages: Ensure that the quotes you compare have the same types of coverage. For example, compare comprehensive policies with other comprehensive policies, not with basic liability ones.

- Policy Limits: Check the limits of the coverage. A policy with low limits might not provide enough protection in case of a serious accident.

- Deductibles: A higher deductible can lower your premium, but it means more out-of-pocket costs if you have an accident. Make sure to compare policies with the same deductible amounts for an accurate comparison.

By keeping these factors in mind, you can ensure that you’re not just getting the cheapest rate but also the best value for your coverage needs.

Next, we’ll explore the benefits of using free insurance comparison tools.

Conclusion

Comparing insurance quotes is a crucial step in finding the best car insurance for your needs. It helps you understand your options, ensuring you get the best value for your money. By looking at different insurers, you can find personalized quotes that fit your budget and coverage needs.

NUsure makes this process easy. With our free insurance comparison tools, you can get quotes from multiple top carriers in one place. This saves you time and effort, allowing you to focus on what matters most.

Personalized quotes mean you get coverage custom to your unique situation. Whether you need comprehensive coverage or just basic liability, NUsure helps you find the right policy at the right price.

Saving time and money is another benefit of using NUsure. By comparing quotes online, you avoid the hassle of contacting multiple insurers individually. Plus, you can quickly identify the best deals, ensuring you don’t overspend on your car insurance.

Finally, NUsure offers year-round policy monitoring. This means we keep an eye on your policy and notify you of any potential savings or better coverage options. You’re never left wondering if you could be getting a better deal.

Ready to find the best car insurance for you? Start your free quote with NUsure now and experience the difference today. Save time, save money, and drive with peace of mind.