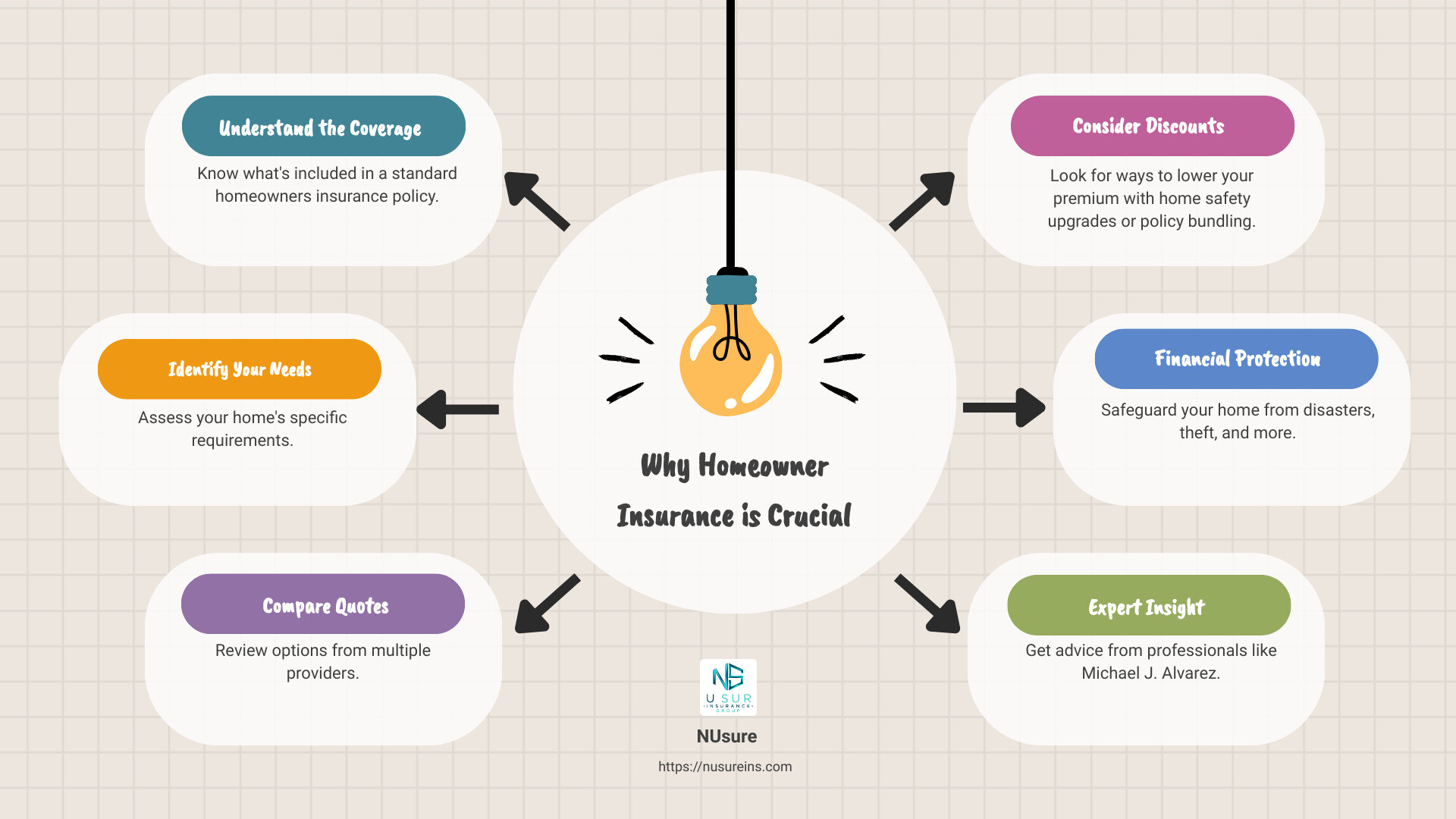

Why Homeowner Insurance is Crucial

Searching for the best homeowner insurance quotes can feel like a daunting task. But finding the right one can save you time, money, and stress. Here’s a quick highlight for those in a hurry:

- Understand the Coverage: Know what’s included in a standard homeowners insurance policy.

- Identify Your Needs: Assess your home’s specific requirements.

- Compare Quotes: Review options from multiple providers.

- Consider Discounts: Look for ways to lower your premium with home safety upgrades or policy bundling.

Homeowner insurance is a vital part of financial protection for any property owner. This policy not only safeguards your home from disasters but also protects your personal belongings and offers liability coverage. Whether it’s fire, storm damage, or theft, having the right insurance ensures you’re covered when life happens.

I’m Michael J. Alvarez, CPRM, CPIA, an expert in homeowner insurance quotes with years of experience in the Florida and New Jersey markets. My goal is to make navigating insurance options simple, saving you time and money.

Understanding Homeowner Insurance

Homeowner insurance is a critical safeguard for your property and personal belongings. It provides financial protection against various risks, ensuring peace of mind. Let’s break down the essential coverage types included in a standard homeowner insurance policy.

Coverage Types

Property Damage: This covers damage to your home and other structures on your property, like sheds or garages. If a storm, fire, or another covered event damages your home, your insurance helps pay for repairs or rebuilding.

Personal Property: This protects your belongings inside the home, such as furniture, electronics, and clothing. If these items are stolen or damaged by a covered event, your policy helps replace them.

Personal Liability: If someone gets injured on your property, personal liability coverage can help pay for their medical bills and any legal fees if they decide to sue. For example, if a guest slips and falls in your home, this coverage can be a lifesaver.

Medical Bills: Separate from personal liability, this covers minor medical expenses if a guest is injured on your property, regardless of fault. It’s designed for smaller incidents, like a friend tripping over a rug.

Living Expenses: If your home is uninhabitable due to a covered event, this coverage helps pay for additional living expenses, such as hotel stays and meals, while your home is being repaired.

Why These Coverages Matter

Imagine a hailstorm damages your roof. You’d file a claim with your insurance company. After assessing the damage, they would pay for repairs minus your deductible. This process ensures you’re not left shouldering the entire financial burden.

Without personal liability coverage, you could face hefty legal fees and medical bills if someone is injured on your property. Similarly, without personal property coverage, replacing stolen or damaged items could be financially draining.

Real-life Example

Consider the case of Sarah, who experienced a fire that destroyed part of her home. Thanks to her comprehensive homeowner insurance, she received funds to rebuild her damaged rooms and replace her lost belongings. Additionally, her policy covered her hotel stay during the reconstruction, easing her financial strain during a stressful time.

Additional Considerations

While standard policies cover many scenarios, some events like floods and earthquakes typically require separate policies. If you live in a high-risk area, investing in additional coverage is wise.

Understanding these coverage types helps you make informed decisions when comparing homeowner insurance quotes. By knowing what protection you need, you can tailor your policy to fit your unique situation and avoid unexpected costs.

Up next, we’ll dive into the 80% rule in homeowners insurance and how it impacts your coverage needs.

The 80% Rule in Homeowners Insurance

The 80% rule is a key guideline in homeowners insurance that can impact how much you receive when you file a claim. Understanding this rule helps ensure you’re not underinsured and can avoid penalties.

Replacement Cost

Replacement cost is the amount it would take to rebuild your home from scratch, using similar materials and construction methods. This includes labor, materials, and other expenses. It’s different from the market value or the tax-assessed value of your home.

Coverage Guidelines

To fully benefit from your homeowner insurance policy, you generally need to insure your home for at least 80% of its replacement cost. This ensures you have enough coverage to rebuild your home in the event of a total loss. If you insure for less than 80%, you could face penalties when filing a claim.

Underinsured Penalties

If you don’t meet the 80% rule, your insurance company may not cover the full cost of partial damages. For example, if your home’s replacement cost is $200,000, you should insure it for at least $160,000 (80% of $200,000). If you only insure it for $140,000 and suffer a $50,000 loss, your insurer might only cover a portion of that loss.

Example Calculation:

- Replacement Cost: $200,000

- Required Coverage (80%): $160,000

- Actual Coverage: $140,000

- Claim Amount: $50,000

Since $140,000 is only 70% of the replacement cost, the insurer may only cover 70% of the claim, which would be $35,000. The remaining $15,000 would come out of your pocket.

Real-life Example

Take a homeowner who insured their home for only 70% of its replacement cost. When a kitchen fire caused $30,000 in damages, their insurer only paid $21,000, leaving the homeowner to cover the remaining $9,000. Had they insured their home for at least 80%, they would have been better protected financially.

Avoiding Penalties

To avoid being underinsured:

- Assess Your Rebuilding Costs: Work with your insurance agent or a trusted contractor to estimate the cost to rebuild your home.

- Regularly Review Your Policy: Ensure your coverage keeps pace with rising construction costs and home improvements.

- Consider Extended Replacement Coverage: Some policies offer extended replacement cost coverage, providing extra funds if rebuilding costs exceed your policy limits.

Understanding the 80% rule helps you make informed decisions when comparing homeowner insurance quotes. By ensuring adequate coverage, you can avoid unexpected costs and better protect your investment.

Next, we’ll explore how to get the best homeowner insurance quotes and what information you need to provide.

How to Get the Best Homeowner Insurance Quotes

Information Needed for a Quote

Getting the best homeowner insurance quotes involves a bit of legwork but is well worth the effort. Here’s a step-by-step guide to help you steer the process and gather the necessary information.

Multiple Quotes

Start by collecting multiple quotes from different insurance providers. Comparing quotes allows you to see the range of options available and helps you find the best deal. Aim for at least three quotes to get a good sense of the market.

Comparison

When comparing quotes, look at more than just the price. Consider the coverage limits, deductibles, and any additional benefits or discounts. Use a home insurance calculator to estimate how much coverage you need, and ensure the policies you’re comparing meet these needs.

Coverage Needs

Identify your coverage needs based on the value of your home and belongings. Standard policies usually cover dwelling, personal property, liability, and additional living expenses. If you have high-value items, you might need additional coverage.

Deductible Amounts

Your deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles usually mean lower premiums, but make sure you choose a deductible you can afford in case of a claim.

Personal Details

Insurance companies will ask for some personal details to provide an accurate quote. This includes:

- Your name and contact information

- Date of birth

- Marital status

- Social Security number (in some cases)

Property Details

You’ll also need to provide property details to help insurers assess the risk and determine your premium. This includes:

- Address of the home

- Year the house was built

- Size of the living area

- Number of stories and bathrooms

- Type of foundation and roof

- Age of the roof

- Type of exterior (wood, stone, stucco, etc.)

- Presence of a garage (attached or detached)

- Distance to the nearest fire hydrant and fire station

Coverage Preferences

Finally, specify your coverage preferences. This includes:

- Amount of dwelling coverage

- Personal property coverage

- Liability coverage

- Optional coverages like flood or earthquake insurance

- Any discounts you might qualify for (e.g., bundling with auto insurance, installing safety devices)

Gathering this information in advance will make the quote process smoother and quicker. Plus, it ensures you get the most accurate and competitive quotes possible.

Next, we’ll dive into our top 5 tips for finding affordable homeowner insurance.

Top 5 Tips for Finding Affordable Homeowner Insurance

Finding affordable homeowner insurance doesn’t have to be a headache. Here are five practical tips to help you save money while getting the coverage you need.

1. Bundle Policies

Bundling policies is one of the easiest ways to save on homeowner insurance. Many insurers offer discounts if you combine your home and auto insurance. You can often save a significant percentage on your premiums when you bundle these policies.

2. Home Safety Devices

Installing home safety devices can also lower your premium. Insurance companies often offer discounts for homes equipped with:

- Burglar alarms

- Smoke detectors

- Fire sprinklers

- Centrally monitored security systems

These devices reduce the risk of damage or loss, making your home less expensive to insure.

3. Deductible Adjustments

Adjusting your deductible can have a big impact on your premium. A higher deductible usually means a lower premium. However, make sure you choose a deductible amount you can afford to pay out of pocket in case of a claim. For example, if you raise your deductible from $500 to $1,000, you might see a noticeable reduction in your annual premium.

4. Discounts

Take advantage of all available discounts. You may qualify for discounts if you:

- Purchase a new home (even if it’s not newly built)

- Have a good credit score

- Are a non-smoker

- Stay claim-free for a certain period

Different insurers offer different discounts, so it’s worth asking about all potential savings when getting quotes.

5. Preventive Maintenance

Regular preventive maintenance can help you avoid costly claims and keep your premiums lower. Addressing issues like plumbing leaks, roof repairs, and electrical problems can prevent major damage. Some insurers even offer discounts for proactive measures that reduce risk.

By following these tips, you can find affordable homeowner insurance that fits your needs and budget. In the next section, we’ll answer some frequently asked questions about homeowner insurance quotes.

Frequently Asked Questions about Homeowner Insurance Quotes

What factors affect the cost of homeowners insurance?

Several factors influence the cost of homeowners insurance. Here are the key ones:

Location

Your home’s location plays a big role in determining your premium. If you live in an area prone to natural disasters like floods or earthquakes, expect to pay more. Proximity to a fire station or hydrant can also impact your rates.

Home Value

The value of your home directly affects your insurance cost. More expensive homes cost more to insure because they would cost more to rebuild.

Coverage Amount

The amount of coverage you choose will impact your premium. Higher coverage limits mean higher premiums but also more protection.

Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible can lower your premium, but make sure it’s an amount you can afford if you need to file a claim.

How many quotes should you get for homeowners insurance?

Experts recommend getting at least three quotes from different insurance companies. This allows you to compare coverage options and rates to find the best deal.

Comparison shopping is crucial. Each insurer evaluates risk differently, so prices can vary widely. By comparing multiple quotes, you can ensure you’re getting the best rates for the coverage you need.

How can you lower your homeowners insurance premium?

Here are some effective ways to lower your homeowners insurance premium:

Bundling

Combine your home and auto insurance with the same provider to get a discount. Many insurers offer significant savings for bundling policies.

Safety Features

Installing safety features like burglar alarms, smoke detectors, and fire sprinklers can reduce your premium. These devices lower the risk of damage or loss, making your home cheaper to insure.

Higher Deductible

Opting for a higher deductible can lower your premium. Just make sure you can afford the deductible amount in case you need to file a claim.

Discounts

Take advantage of available discounts. You may qualify for savings if you have a good credit score, are a non-smoker, or stay claim-free for a certain period. Always ask your insurer about possible discounts when getting quotes.

By understanding these factors and strategies, you can make informed decisions to get the best homeowner insurance quotes.

Next, we’ll explore more detailed aspects of homeowners insurance to help you make the best choice for your needs.

Conclusion

Finding the best homeowner insurance quotes can be a daunting task, but that’s where we come in. At NUsure, we make the process simple and efficient, ensuring you get the best coverage custom to your needs.

Personalized Policies:

We understand that every home and homeowner is unique. That’s why we offer personalized policies. When you complete one form, we match you with quotes from top carriers in your area. This means you get a policy that fits your specific requirements and budget.

Year-Round Monitoring:

Insurance needs can change over time. We provide year-round monitoring to ensure your policy remains the best fit for you. Whether it’s a change in your home’s value or new discounts becoming available, we keep an eye on your policy so you don’t have to.

Saving Time and Money:

With NUsure, you save both time and money. Instead of spending hours researching and comparing different options, we do the hard work for you. Plus, our network of over 50 A-rated carriers ensures you get the most competitive rates.

Ready to protect your home with a personalized insurance policy? Start your free quote now and find the NUsure difference today. You can get peace of mind knowing your home is protected against the unexpected. Start your journey with NUsure, your trusted insurance partner.