Most Affordable Term Life Insurance: Top 7 Savvy Buys

Why Choosing the Most Affordable Term Life Insurance Matters More Than Ever

The most affordable term life insurance can be found for as little as $20-30 per month for a healthy 30-year-old, yet 3 in 4 Americans overestimate these costs and nearly half avoid buying coverage because they think it’s too expensive.

Term life insurance is significantly more affordable than whole life insurance because it provides pure death benefit protection for a fixed period (typically 10-40 years) without a complex cash value component. This makes it an ideal choice for families who need robust financial protection without overextending their budget.

At its heart, life insurance is a financial safety net for the people you love. If you pass away during the policy’s term, your beneficiaries receive a predetermined, tax-free payout to cover expenses like mortgage payments, daily living costs, and future educational needs. The key is to act fast, as rates can increase by 4.9% to 9% for every year you age.

Most affordable term life insurance helpful reading:

- life insurance options

- increasing term life insurance policy

- converting group life insurance to individual coverage

Think of term life as renting an apartment: you get the full benefit of protection for a set period at an affordable rate. Whole life is more like buying a house: it’s meant to last forever and builds equity (cash value), but the cost is substantially higher. For most families, the targeted protection of term life during their most financially vulnerable years offers the perfect balance of coverage and cost.

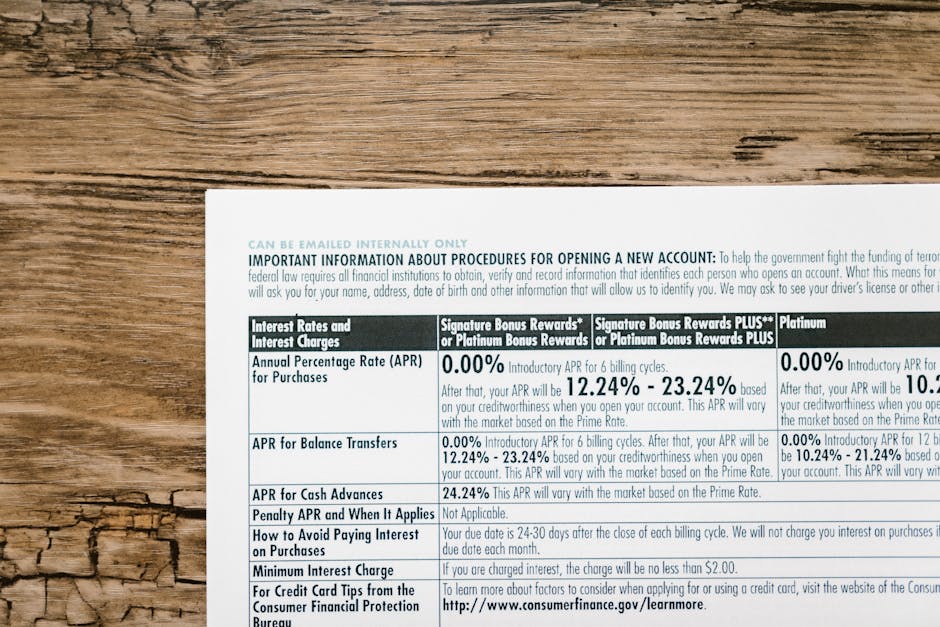

For a clearer picture of the fundamental differences between term and permanent life insurance, including their coverage and cost implications, take a look at this infographic:

Our Top Picks for the Most Affordable Term Life Insurance Categories

Shopping for the most affordable term life insurance isn’t one-size-fits-all. The best policy depends on your life stage and financial goals. We’ve organized our recommendations into categories to help you find the right fit.

Best for No-Medical-Exam Convenience

No-medical-exam policies use online applications and advanced algorithms to assess risk, allowing you to get covered in days instead of weeks. Some policies offer coverage up to $3 million without a single needle. This is an excellent option for healthy individuals with uncomplicated medical histories who need coverage quickly and want to avoid the hassle of a medical exam.

For more insights into finding the right coverage approach, check out life insurance options available today.

Best for Maximum Flexibility and Customization

Flexible policies allow you to tailor coverage to your life. A popular strategy is “laddering,” where you layer multiple smaller policies with different term lengths to match specific financial obligations, like a mortgage or college tuition. As a debt is paid off, the corresponding policy expires, lowering your overall cost. Some insurers also offer non-standard term lengths and conversion options, which let you switch to a permanent policy later without a new health exam.

To understand how your coverage might grow with your needs, explore options like an increasing term life insurance policy.

The most affordable term life insurance for young families on a budget

Being young and healthy is your superpower when buying life insurance. You can secure the lowest possible premiums and lock them in for decades. For new parents and first-time homeowners, long-term options (30 or 40 years) provide coverage for the entire period your children are financially dependent. High coverage limits are also more affordable when you’re young, ensuring you can replace decades of future income for your family.

Best for Seniors Seeking Final Expense Coverage

For those over 50, life insurance needs often shift to covering final expenses. Guaranteed issue policies are designed for this purpose. Available for ages 50-85, they offer smaller death benefits (typically $2,000 to $25,000) to cover funeral costs and final medical bills. Crucially, acceptance is guaranteed regardless of your health history—no medical exam or health questions are required. This provides peace of mind that these costs won’t burden your loved ones.

For more details on these options, explore the best guaranteed acceptance life insurance available.

Best for Valuable “Living Benefits”

Some policies include “living benefits,” which allow you to access your death benefit while you are still alive if you face a qualifying serious illness. These accelerated death benefit riders are often included at no extra cost. If you’re diagnosed with a terminal or chronic illness, you can access a portion of the funds to pay for medical treatments, in-home care, or even a final family vacation. This feature adds a powerful layer of financial protection for you, not just your beneficiaries.

To better understand how these benefits work, check out how does life insurance work?.

Best for High-Coverage Needs

For high-net-worth individuals, business owners, or those with significant assets, death benefits over $3 million may be necessary. This level of coverage can replace a substantial income, fund a business buyout agreement, or provide liquidity to pay estate taxes, ensuring assets are passed on intact. When seeking high-limit policies, choose an insurer with top-tier financial strength ratings to guarantee the company can honor a large claim.

If you’re considering substantial coverage, you might be curious about how much is a million dollar life insurance policy?.

Best for Excellent Customer Satisfaction

While price is important, so is service. A company with high customer satisfaction ratings and low official complaint rates is more likely to provide a smooth, supportive experience, especially when your family needs to file a claim. Some insurers also offer bundling discounts, allowing you to save money by purchasing your life insurance with your auto or home policies. Prioritizing service can be a wise long-term decision.

Before committing, it’s smart to check an insurer’s financial strength rating to ensure they can meet their long-term obligations.

What Determines the Cost of Your Term Life Insurance?

Insurers assess your risk to determine your premium. Understanding these factors is key to finding the most affordable term life insurance.

- Age: This is the biggest factor. Premiums increase by 4.9% to 9% every year you wait to buy coverage.

- Health Status: Your medical history, weight, blood pressure, and any chronic conditions are reviewed. A medical exam can prove you’re a low-risk candidate and lock in a lower rate.

- Gender: Women tend to live longer and therefore typically pay slightly less than men for the same coverage.

- Tobacco Use: This is a major red flag for insurers. Smokers and other tobacco users can expect to pay two to three times more than non-smokers. Most companies require you to be tobacco-free for at least 12 months to qualify for non-smoker rates.

- Lifestyle and Hobbies: High-risk hobbies like skydiving or motorcycle racing can increase your premiums.

- Occupation: A high-risk job, such as a commercial fisherman or oil rig worker, will result in higher premiums than a desk job.

- Coverage Amount & Term Length: The more coverage you buy and the longer the term, the higher your monthly premium will be. However, a longer term often provides better long-term value by locking in your rate while you’re young and healthy.

Here’s how these factors translate to monthly costs for a $500,000, 20-year term policy:

| Age & Gender | Non-Smoker Monthly Cost ($) | Smoker Monthly Cost (Est. $) |

|---|---|---|

| 30-year-old Female | $23 | $46 – $69 |

| 30-year-old Male | $29 | $58 – $87 |

| 40-year-old Female | $35 | $70 – $105 |

| 40-year-old Male | $43 | $86 – $129 |

Note: Smoker costs are estimated at 2-3 times non-smoker rates based on general industry guidelines. Actual rates will vary by individual health, specific company, and other factors.

These numbers show why acting sooner rather than later is crucial. You can’t change your age, but you can improve your health, quit smoking, and choose coverage that fits your budget. When you’re ready, services that help you find better insurance rates can show you how these factors play out across different companies.

5 Smart Ways to Lower Your Term Life Insurance Costs

Finding the most affordable term life insurance is achievable with a few smart strategies. While some cost factors are out of your control, these five actions can significantly reduce your premiums.

Buy When You’re Young and Healthy. Your age and health are the biggest drivers of cost. By purchasing a policy in your 20s or 30s, you can lock in the lowest possible rates for the entire term, potentially saving thousands over time.

Improve Your Health. Insurers reward healthy habits. Taking steps to lower your blood pressure, lose weight, or manage a chronic condition before applying can help you qualify for a better health class and a lower premium.

Quit Smoking. This is the single most impactful way to slash your costs. Smokers pay 2-3 times more than non-smokers. Most insurers require you to be tobacco-free (including vaping) for at least one year to qualify for non-smoker rates.

Choose the Right Coverage. Don’t just pick a large, round number. Carefully calculate your family’s actual needs (considering debts, income replacement, and future education costs) to avoid paying for more coverage than you need. Aligning your term length to a specific goal, like paying off a mortgage, also prevents over-insuring.

Comparison Shop Extensively. Every insurer assesses risk differently, meaning the price for the same policy can vary widely between companies. The only way to ensure you’re getting the best deal is to compare quotes from multiple carriers.

This is where NUsure simplifies the process. We shop the market for you, comparing over 50 top-rated carriers to help you find better insurance rates without the hassle. By using these strategies, you can secure the protection your family needs at a price you can afford.

Frequently Asked Questions About Finding the Most Affordable Term Life Insurance

Navigating life insurance can bring up a lot of questions. Here are clear, straightforward answers to some of the most common concerns about finding the most affordable term life insurance.

What are the drawbacks of choosing the absolute cheapest policy?

While a low price is tempting, the absolute cheapest policy might come with trade-offs. It could lack important features, known as riders, like the ability to access funds if you become terminally ill (accelerated death benefits) or the option to convert your term policy to a permanent one later. It might also come from an insurer with lower financial strength ratings or a reputation for poor customer service, which can be a major issue when your family needs support the most. The goal is to find the best value, not just the lowest price.

Is life insurance from my job enough?

Employer-sponsored life insurance is a great benefit, but it’s rarely enough on its own. These policies typically offer low coverage amounts (often just one to two times your annual salary), which is far less than the 10-12 times income that experts recommend. More importantly, this coverage is usually not portable; if you leave your job, you lose your insurance. An individual term policy that you own directly is the best way to ensure your family has adequate, stable protection. You can learn more about employee supplemental term life insurance.

How much term life insurance do I actually need?

A common rule of thumb is to get coverage equal to 10-12 times your annual income. For a more precise figure, you can use the DIME method, which prompts you to add up your:

- Debt (mortgage, credit cards, student loans)

- Income replacement needs

- Mortgage balance

- Education costs for your children

Online calculators can also provide a personalized estimate. The goal is to provide enough money for your family to maintain their lifestyle and achieve their goals without financial hardship.

Conclusion: Secure Your Family’s Future Today

We’ve covered how to find the most affordable term life insurance, from understanding its value to using smart strategies to lower your costs. You now have the tools to make a confident decision that protects your loved ones.

Term life insurance is a powerful and affordable tool. For a modest monthly premium, you can secure a significant financial safety net for your family during their most vulnerable years. The “best” policy is one that provides the right amount of coverage from a reliable company at a price that fits your budget.

The key is to compare your options. Insurers price policies differently, and the only way to find the best rate for your unique situation is to shop the market. As a licensed independent insurance broker, NUsure works for you, not for any single insurance company. We shop your profile with over 50 top-rated carriers to find you personalized, affordable insurance options.

There are no hidden fees or pressure, just honest comparisons to help you find the right fit. We even provide year-round policy monitoring to ensure you always have the best value.

Don’t wait. The cost of life insurance only increases with age. Your family’s financial future is too important to leave to chance. Take the first step today.

Compare life insurance policies now with NUsure and see how affordable peace of mind can be. Your family will thank you for it.