Understanding Personal UAV Liability Insurance Costs

Navigating personal UAV liability insurance can be confusing, but it’s essential for anyone who owns or operates a drone. Whether you’re flying for fun or using your UAV for work, having the right insurance offers peace of mind and financial protection. Here’s what you should know right away:

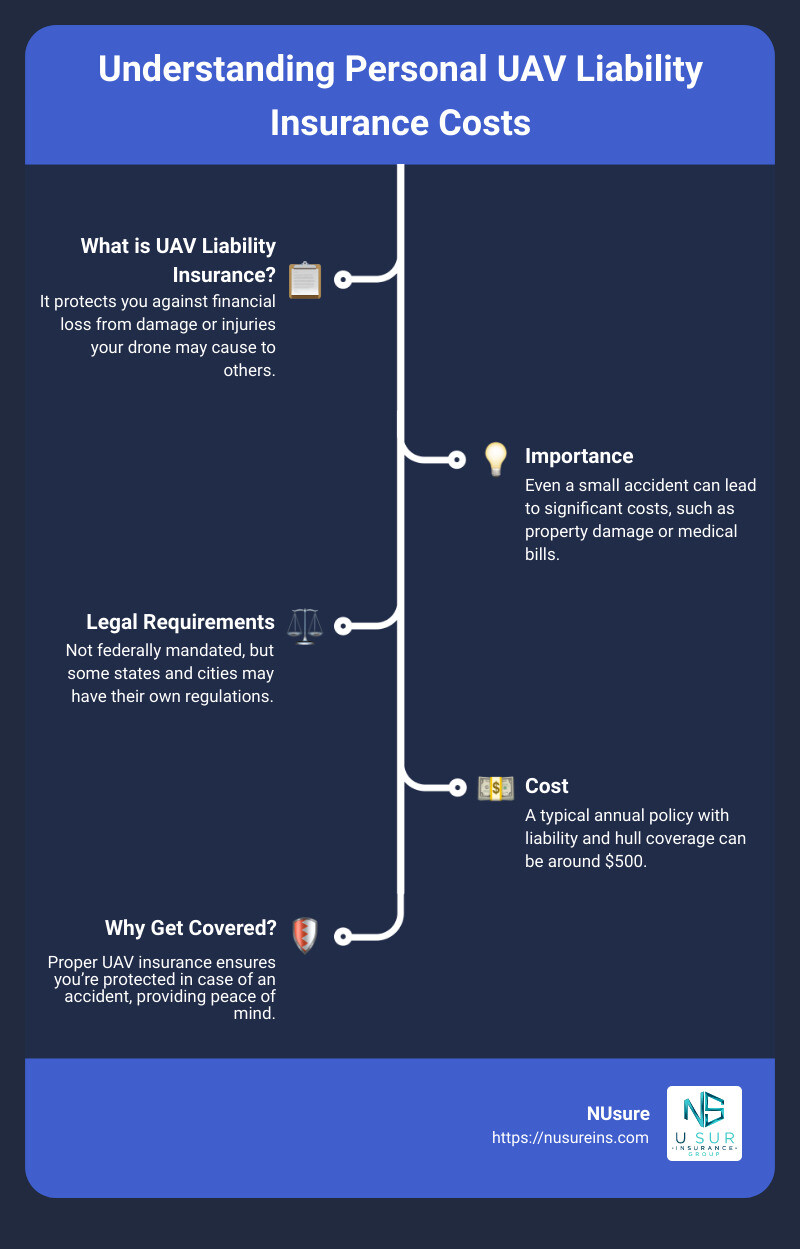

- What is personal UAV liability insurance? It protects you against financial loss from damage or injuries your drone may cause to others.

- Why do you need it? Even a small accident can lead to significant costs, from property damage to medical bills.

- Is it required by law? Not federally, but some states and cities may have their own regulations.

- How much does it cost? Costs vary, but a typical annual policy with liability and hull coverage can be around $500.

In recent years, drones have become more than just gadgets for tech enthusiasts; they are now tools for photographers, surveyors, and hobbyists alike. But with great utility comes great responsibility. Proper UAV insurance ensures you’re not left high and dry in case of an accident. Let’s explore why this kind of coverage is vital for all drone operators.

My name is Michael J. Alvarez, CPRM, CPIA, and I specialize in personal UAV liability insurance. Over the years, I have helped numerous clients steer their insurance needs, ensuring they are adequately covered.

What is Personal UAV Liability Insurance?

Personal UAV liability insurance is a type of coverage that protects you from financial loss if your drone causes damage or injury to others. This insurance is crucial whether you’re flying for fun or using your drone for work.

Coverage Details

- Liability Coverage: This covers any damage your drone might cause to other people or their property. For instance, if your drone crashes into a car or injures someone, liability insurance will cover the repair costs or medical bills.

- Hull Insurance: This covers physical damage to your drone itself. If your drone crashes or gets stolen, hull insurance helps pay for repairs or replacement.

- Payload Insurance: This covers the equipment your drone carries, like cameras or sensors. If these items are damaged, payload insurance can cover the repair or replacement costs.

Why It’s Important

Accidents happen, even to the most skilled pilots. Imagine your drone malfunctioning and falling onto someone’s car, causing significant damage. Without insurance, you’d be responsible for all the repair costs. With personal UAV liability insurance, you’re protected from these unexpected expenses.

Real-World Examples

Consider a photographer using a drone to capture wedding moments. If the drone accidentally hits a guest, the medical bills could be substantial. Liability insurance would cover these costs, saving the photographer from financial hardship.

In another case, a hobbyist flying a drone in a park could accidentally crash into a statue, causing damage. Here, liability insurance would cover the repair costs, ensuring the hobbyist isn’t out of pocket.

Legal Requirements

While there isn’t a federal law mandating UAV insurance, some states and cities have their own regulations. For example, some areas may require a minimum amount of liability coverage to operate a drone legally. Always check local regulations to ensure compliance.

Cost Factors

The cost of personal UAV liability insurance varies based on several factors, including:

- Type of Drone: More expensive drones usually cost more to insure.

- Usage: Commercial use often requires more coverage than recreational use.

- Location: Flying in populated areas might increase your premiums.

- Coverage Amount: Higher coverage limits mean higher premiums.

- Pilot Experience: Experienced pilots may get lower rates.

Understanding these elements can help you choose the right policy and ensure you’re adequately covered. Next, let’s dig into the different types of UAV insurance coverage available.

Flying drones can be exciting, but it also comes with risks. Here’s why personal UAV liability insurance is crucial for drone operators:

Legal Requirements

While there’s no federal law requiring UAV insurance, many states and cities have their own rules. For example, some places require a minimum amount of liability coverage to fly a drone legally. Always check your local regulations to ensure you’re compliant.

Financial Protection

Imagine your drone malfunctioning and crashing into someone’s car. The repair costs could be substantial. Without insurance, you’re responsible for all those expenses. With personal UAV liability insurance, these costs are covered, saving you from financial hardship.

Peace of Mind

Accidents happen, even to the best pilots. Knowing you’re covered allows you to focus on flying safely and capturing great footage without constantly worrying about potential financial risks.

Accidents

A gust of wind or a sudden obstacle can send your drone tumbling. If it injures someone or damages property, you could face significant financial liability. Insurance covers these unexpected events, ensuring you’re not left out of pocket.

Property Damage

Your drone could accidentally crash into a building, car, or other property. Repairing or replacing damaged property can be costly. Liability insurance covers these repair costs, protecting you from unexpected expenses.

Injuries

If your drone injures someone, medical bills can be high. For instance, if a drone hits a wedding guest, the photographer could face substantial medical expenses. Liability insurance covers these costs, ensuring you’re not financially strained.

Real-World Examples

Consider a hobbyist flying a drone in a park. If the drone crashes into a statue, causing damage, liability insurance would cover the repair costs. Similarly, a drone used for real estate tours could malfunction and hit a bystander. Without insurance, the operator would be liable for medical bills and damages.

Conclusion

Having personal UAV liability insurance is essential for protecting yourself from financial risks and ensuring peace of mind. Next, let’s dig into the different types of UAV insurance coverage available.

Types of UAV Insurance Coverage

When it comes to insuring your drone, there are several types of coverage available. Understanding these options will help you choose the best policy for your needs.

Liability Insurance

Liability insurance is the most basic and essential type of coverage. It protects you if your drone causes damage to property or injures someone. For example, if your drone crashes into a car or hits a person, liability insurance covers the repair costs and medical bills. This type of insurance is crucial, especially if you fly in populated areas or near sensitive infrastructure.

Hull Insurance

Hull insurance covers physical damage to your drone itself. If your drone crashes or gets damaged, hull insurance will pay for repairs or even replace the drone if it’s beyond repair. This is particularly important for high-end drones, where repair costs can be substantial. For instance, if a gust of wind sends your drone tumbling, hull insurance ensures you’re not left with a hefty repair bill.

Payload Insurance

For those using drones to carry valuable equipment, payload insurance is a must. This coverage protects the items your drone carries, such as cameras, LIDAR lasers, or other specialized gear. If these items get damaged or lost during a flight, payload insurance covers the replacement costs. This is vital for commercial operators who rely on expensive equipment for their work.

Comprehensive Coverage

Comprehensive coverage combines all the above types of insurance into one policy. It includes liability, hull, and payload insurance, offering complete protection for both the drone and its operator. This type of coverage is ideal for those who want peace of mind knowing they are fully protected against all potential risks. Comprehensive policies often come with higher premiums but provide the most extensive protection.

Real-World Examples

Consider a photographer using a drone for real estate tours. If the drone crashes into a window, liability insurance covers the repair costs. If the drone itself is damaged, hull insurance pays for the repairs. If the camera attached to the drone is broken, payload insurance covers the cost of a new camera. For complete protection, a comprehensive policy would cover all these scenarios.

Understanding these different types of UAV insurance coverage helps you make an informed decision. Next, let’s explore the costs associated with personal UAV liability insurance.

How Much Does Personal UAV Liability Insurance Cost?

When it comes to personal UAV liability insurance, understanding the costs involved can help you make an informed decision. Here, we’ll break down the average costs, factors that affect pricing, coverage limits, annual premiums, and some cost-saving tips.

Average Cost

The cost of personal UAV liability insurance varies based on several factors. On average, an annual policy can start around $500. This price typically includes both liability and hull insurance, offering a balanced level of protection for most drone pilots.

Factors Affecting Cost

Several factors can influence the cost of your personal UAV liability insurance:

- Type of Drone: High-end drones with advanced features usually cost more to insure.

- Usage: Commercial use tends to have higher premiums compared to recreational use.

- Location: Flying in high-risk areas, such as crowded cities, can increase your insurance costs.

- Coverage Amount: Higher coverage limits mean higher premiums.

- Deductible: A higher deductible can lower your premium, but you’ll pay more out-of-pocket if you make a claim.

- Pilot Experience: Experienced pilots with a good track record may get lower rates.

Coverage Limits

Coverage limits refer to the maximum amount your insurance policy will pay out in the event of a claim. For liability insurance, limits typically start at $500,000 and can go up to $10 million. The coverage limit you choose will significantly impact your premium. Make sure the limit is sufficient to cover potential damages or injuries your drone could cause.

Annual Premiums

Annual premiums for personal UAV liability insurance can range from $500 to $1,000 or more, depending on the factors mentioned above. For instance, a policy with a $1 million liability limit might cost around $700 per year. Adding hull insurance to cover drone damage could increase the premium to $900 or $1,000 annually.

Cost-Saving Tips

Here are some tips to help you save on your personal UAV liability insurance:

- Bundle Policies: Combining liability and hull insurance into a single comprehensive policy can sometimes be cheaper than buying them separately.

- Increase Deductibles: Opting for a higher deductible can lower your premium. Just be sure you can afford the out-of-pocket costs if you need to file a claim.

- Shop Around: Compare quotes from multiple insurance providers to find the best rate. NuSure makes this easy by matching you with quotes from top carriers.

- Maintain a Good Flying Record: Demonstrating safe flying practices and having no claims history can help you secure lower premiums.

Understanding the costs associated with personal UAV liability insurance can help you budget effectively and ensure you have the right coverage. Next, let’s dive into the factors that influence UAV insurance costs in more detail.

Factors Influencing UAV Insurance Costs

When it comes to personal UAV liability insurance, several factors can impact how much you’ll pay for coverage. Let’s break down the key elements that influence these costs:

Drone Type

The type of drone you own plays a significant role in determining your insurance premium. High-end drones with advanced features and higher price tags generally cost more to insure than basic models. For example, a high-end professional drone used for aerial photography will have a higher premium than a simple recreational drone.

Usage

How you use your drone also affects the cost. Commercial use typically has higher premiums compared to recreational use. This is because commercial operations often involve higher risks, such as flying in populated areas or performing complex tasks like inspections and deliveries.

Location

Where you fly your drone matters. Operating in high-risk areas, such as crowded cities or near sensitive infrastructure, can increase your insurance costs. These locations pose a higher risk of accidents and liability claims, which insurers factor into your premium.

Coverage Amount

The amount of coverage you choose will significantly impact your premium. Higher coverage limits mean higher premiums. For instance, a policy with a $1 million liability limit will cost more than one with a $500,000 limit. It’s essential to choose a coverage amount that adequately protects you without overpaying for unnecessary limits.

Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Opting for a higher deductible can lower your premium, but you’ll need to pay more if you file a claim. Balancing your deductible with your ability to cover potential out-of-pocket costs is crucial.

Pilot Experience

Your experience as a pilot can also influence your insurance costs. Experienced pilots with a good track record may receive lower rates. Insurers view experienced operators as lower risk, reducing the likelihood of accidents and claims.

Summary Table

| Factor | Impact on Cost |

|---|---|

| Drone Type | High-end drones cost more to insure |

| Usage | Commercial use has higher premiums |

| Location | High-risk areas increase insurance costs |

| Coverage Amount | Higher coverage limits mean higher premiums |

| Deductible | Higher deductibles lower premiums |

| Pilot Experience | Experienced pilots get lower rates |

Understanding these factors can help you make informed decisions about your personal UAV liability insurance. By considering each element, you can find a balance between adequate coverage and affordable premiums.

Next, we’ll explore how to choose the right UAV insurance policy to suit your specific needs.

How to Choose the Right UAV Insurance Policy

Assessing Needs

Before diving into policy options, it’s crucial to assess your specific needs. Ask yourself:

- What type of drone do you have? High-end or basic?

- How do you use your drone? Commercially or recreationally?

- Where do you usually fly? Crowded areas or open spaces?

Understanding these aspects will help you determine the level of coverage you need.

Comparing Policies

Once you’ve assessed your needs, compare multiple policies. Don’t settle for the first offer. Look at:

- Coverage limits: Ensure the policy covers potential damages and liabilities.

- Premium costs: Balance between affordable premiums and comprehensive coverage.

- Deductibles: Higher deductibles can lower premiums but will cost more out-of-pocket if you file a claim.

Understanding Terms

Insurance jargon can be confusing. Make sure you understand:

- Liability coverage: Protects against damages your drone might cause to others.

- Hull insurance: Covers damage to your own drone.

- Exclusions: Know what isn’t covered to avoid surprises later.

Reading Reviews

Check what other drone operators are saying about different insurance providers. Look for:

- Customer service quality: How responsive and helpful is the insurer?

- Claim processing: Are claims handled quickly and fairly?

- Overall satisfaction: Would other customers recommend this provider?

Consulting Experts

If you’re still unsure, consult an expert. Insurance advisors can:

- Provide custom advice: Based on your specific needs and usage.

- Help you understand terms: Clarify any confusing aspects of the policy.

- Offer multiple quotes: Present you with options to choose from.

By following these steps, you can choose a UAV insurance policy that fits your needs and budget. This ensures that both you and your drone are adequately protected.

Next, we’ll tackle some frequently asked questions about personal UAV liability insurance.

Frequently Asked Questions about Personal UAV Liability Insurance

Do I need insurance for my drone?

Yes, you should consider insurance for your drone. Accidents can happen even if you’re a careful pilot. A gust of wind or a technical glitch can lead to property damage or injuries. Without insurance, you could be liable for hefty costs.

Legal Requirements: While there’s no federal law mandating UAV insurance, some states and cities have their own regulations. It’s crucial to check local laws to ensure compliance.

Commercial Use: If you use your drone for commercial purposes, clients often require you to have insurance. This protects both parties in case something goes wrong.

Recreational Use: Even for hobbyists, having insurance provides peace of mind. Some homeowner’s or renter’s insurance policies might cover your drone, but verify the specifics with your provider.

Does FAA require drone insurance?

No, the FAA does not require drone insurance. However, they do have other regulations that you must follow.

FAA Regulations: The FAA mandates that all drones used for commercial purposes must be registered. Recreational users must also register if their drone weighs more than 0.55 pounds.

Part 107 Certification: For commercial drone operators, having a Part 107 certification is often assumed by insurance providers. Without this certification, you may face challenges in claiming damages.

State and Local Requirements: Some states and cities might have additional requirements. Being insured ensures you meet these regulations and can operate your drone legally and safely.

Does insurance cover lost drone?

It depends on the policy. Some insurance plans cover theft or loss, but not all do.

Homeowner’s Insurance: Some homeowner’s policies might cover your drone under “valuable personal property.” However, this often excludes commercial use and might have coverage limitations.

Renter’s Insurance: Similar to homeowner’s insurance, renter’s policies might offer some coverage. Always check the specifics with your provider.

Specialized Drone Insurance: For comprehensive coverage, including theft or loss, specialized drone insurance is recommended. Policies can vary, so it’s crucial to read the terms and conditions.

Coverage Limitations: Be aware of what your policy excludes. Not all policies cover every scenario, so understanding these limitations will help you choose the right coverage.

Next, let’s summarize why having personal UAV liability insurance is crucial and how NUsure can help you find the best policy.

Conclusion

Flying a drone is exciting, but it comes with its own set of risks. Whether you’re a hobbyist or a professional, having personal UAV liability insurance is crucial to protect yourself from unexpected costs and legal issues.

Why Coverage Matters

Accidents happen. A sudden gust of wind or a technical glitch can result in damage to property or even injuries to people. Without insurance, you could be responsible for hefty medical bills and repair costs.

Legal Requirements: While there’s no federal mandate for UAV insurance, some states and cities have their own regulations. Being insured ensures you comply with these local laws and operate your drone legally.

Financial Protection: Insurance acts as a safety net, covering unexpected expenses that could otherwise be financially devastating. Whether it’s for property damage or personal injury, having the right coverage can save you from significant financial hardship.

How NUsure Can Help

At NUsure, we understand the complexities of drone insurance and offer personalized quotes from over 50 top-rated carriers. Our service is designed to save you time and money while ensuring you get the coverage you need.

Personalized Quotes: By filling out one simple form, you can get matched with quotes custom to your specific drone use and needs. This ensures that you find the best policy without any extra fees.

Year-Round Policy Monitoring: Once you have your policy, we don’t stop there. We offer year-round policy monitoring to ensure you always have the best coverage at the best price. This ongoing service means you can fly your drone with confidence, knowing you’re always protected.

Get Started

Protect your drone and yourself with the right insurance. Learn more about our drone insurance options and get your personalized quote today.

Having personal UAV liability insurance isn’t just about following the law—it’s about peace of mind. With NUsure, you can focus on enjoying your drone, knowing you’re covered.

Ready to get started? Click here to find the best UAV insurance for you.