Why UAS Insurance Matters

UAS insurance is becoming more important as unmanned aerial systems (UAS) and unmanned aerial vehicles (UAV), commonly known as drones, gain popularity. Whether used by film producers, search and rescue teams, or hobbyists, having the right insurance can protect from various risks.

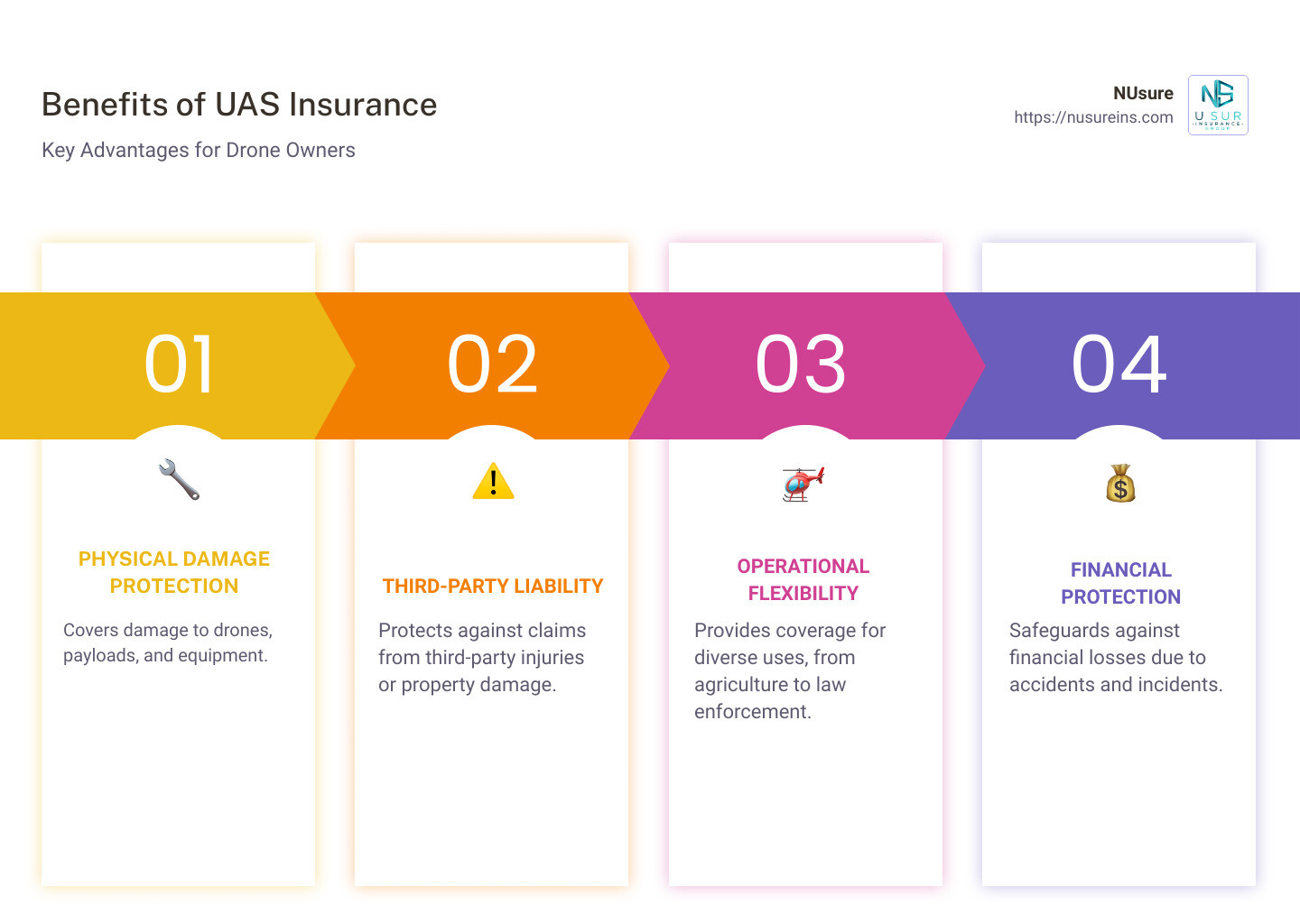

In short, here’s why uas insurance is crucial:

– Physical damage protection: Covers damage to your drone, payload, and equipment.

– Third-party liability: Protects against injury or damage claims from third parties.

– Operational flexibility: Provides coverage for diverse uses, from agriculture to law enforcement.

Without further ado, let’s dive into why having this insurance is essential.

I’m Michael J. Alvarez, CPRM, CPIA. With years of experience in property & casualty risk, particularly in aviation and drone insurance, I aim to make these topics simple to understand. Join me as we explore the ins and outs of safeguarding your unmanned aircraft.

What is UAS Insurance?

UAS insurance (Unmanned Aircraft System insurance) is a specialized type of coverage designed to protect owners and operators of unmanned aerial systems (UAS) or unmanned aerial vehicles (UAVs), commonly known as drones. This insurance is crucial for mitigating risks associated with the use of these advanced technologies.

Understanding UAS and UAV

UAS refers to the entire system required to operate an unmanned aircraft, including the vehicle itself, ground control stations, and other supporting equipment. UAV specifically refers to the drone or aerial vehicle that is operated remotely without a human pilot onboard.

Types of Insurance Coverage

UAS insurance provides a range of coverages to address the unique risks associated with operating unmanned aircraft. Here are the key types of coverage you might need:

Physical Damage Coverage: Protects against damage to the drone, its payload (such as cameras and sensors), and ground equipment. This ensures that you can repair or replace your equipment without bearing the full cost yourself.

Third-Party Liability Coverage: Covers legal liabilities if your drone causes property damage or bodily injury to others. For example, if your drone crashes into a building and breaks a window, this coverage would handle the repair costs and any legal fees if you are sued.

Payload Insurance: Specifically covers the valuable equipment attached to your drone, such as high-end cameras or LIDAR sensors. This is especially important for commercial users who rely on these tools for their work.

Personal Injury Coverage: Provides protection if you or others specified on your policy are injured in an accident involving your drone.

Non-Owned Coverage: Offers liability protection when you operate a drone that you do not own. This is useful for pilots who rent or borrow drones for specific tasks.

Real-World Applications

UAS insurance is essential for a variety of industries:

- Film and Photography: Ensures that expensive equipment and footage are protected during shoots.

- Agriculture: Covers drones used for crop monitoring, pesticide application, and land surveying.

- Law Enforcement: Protects drones used in surveillance, search and rescue, and crowd management.

Why You Need UAS Insurance

Operating drones comes with inherent risks, whether it’s a crash, a malfunction, or an accident causing injury. Having uas insurance not only provides peace of mind but also ensures compliance with certain legal and contractual obligations. For instance, many clients and venues require proof of insurance before allowing drone operations on their premises.

In summary, uas insurance is a vital safeguard for anyone involved in the operation of unmanned aircraft systems. It provides comprehensive protection against a wide range of risks, ensuring that you can focus on your work without worrying about potential financial setbacks.

Next, we’ll explore the different components of UAS insurance policies in detail.

Types of UAS Insurance Coverage

When it comes to protecting your unmanned aircraft, UAS insurance offers several types of coverage to address the unique risks involved. Here are the key types of coverage you should consider:

Physical Damage Coverage

Physical Damage Coverage protects your drone, its payload, and ground equipment from various risks. This includes damage from crashes, weather events, theft, or even unexpected incidents on the ground.

- Drone and Payload: Covers the cost of repairing or replacing the drone and any attached equipment, like cameras or sensors.

- Ground Equipment: Includes coverage for essential gear used to operate the drone, such as control stations and spare parts.

Third-Party Liability Coverage

Third-Party Liability Coverage is essential if your drone causes property damage or bodily injury to others. This coverage handles the costs associated with these incidents, including legal fees.

- Property Damage: If your drone crashes into a building or vehicle, this coverage pays for the repairs.

- Bodily Injury: Covers medical expenses and legal fees if someone is injured by your drone.

Payload Insurance

Payload Insurance is crucial for commercial users who rely on specialized equipment attached to their drones. This coverage ensures that you can replace or repair these valuable tools without incurring high out-of-pocket costs.

- Cameras and Sensors: Protects high-end photography equipment, LIDAR lasers, thermal cameras, and other specialized gear.

Personal Injury Coverage

Personal Injury Coverage provides protection if you or others specified on your policy are injured during drone operations. This is particularly important for operators who frequently work in challenging environments.

- Medical Expenses: Covers medical bills for injuries sustained in drone-related accidents.

Non-Owned Coverage

Non-Owned Coverage is vital for pilots who rent or borrow drones for specific tasks. This coverage offers liability protection when you operate a drone that you do not own, ensuring that you are not financially liable for incidents that occur during its use.

- Rental Drones: Provides peace of mind when using borrowed or rented drones for short-term projects.

Real-World Applications

UAS insurance is not just a luxury; it’s a necessity across various industries. Here are some examples:

- Film and Photography: Protects expensive equipment and footage during shoots.

- Agriculture: Covers drones used for crop monitoring, pesticide application, and land surveying.

- Law Enforcement: Ensures drones used in surveillance, search and rescue, and crowd management are protected.

Why You Need UAS Insurance

Operating drones comes with inherent risks, whether it’s a crash, a malfunction, or an accident causing injury. Having uas insurance not only provides peace of mind but also ensures compliance with certain legal and contractual obligations. For instance, many clients and venues require proof of insurance before allowing drone operations on their premises.

In summary, uas insurance is a vital safeguard for anyone involved in the operation of unmanned aircraft systems. It provides comprehensive protection against a wide range of risks, ensuring that you can focus on your work without worrying about potential financial setbacks.

Next, we’ll explore the different components of UAS insurance policies in detail.

Why You Need UAS Insurance

Operating unmanned aircraft systems (UAS) comes with a unique set of risks and responsibilities. Whether you’re a hobbyist or a commercial operator, UAS insurance is essential for several reasons:

Risks

Drones can crash, malfunction, or cause accidents that lead to property damage or personal injury. Imagine a drone crashing into a car or a person during a public event. Without insurance, you could be on the hook for costly repairs or medical bills.

FAA Regulations

The Federal Aviation Administration (FAA) has specific regulations for drone operations, especially for commercial use. Some of these rules require operators to have insurance. For example, if you’re flying a drone over 55 pounds or for commercial purposes, you may need to show proof of insurance to comply with FAA guidelines.

Operational Safety

Insurance adds an extra layer of safety for your operations. If something goes wrong, you have the financial backing to handle the situation. This is crucial for industries like agriculture, law enforcement, and film production, where drones are used for critical tasks.

Financial Protection

Accidents happen, and when they do, they can be expensive. UAS insurance provides financial protection against potential losses. This includes coverage for physical damage to the drone, liability for third-party injuries, and even personal injury to the operator.

Real-World Examples

- Law Enforcement: Drones are used in search and rescue missions, crowd control, and surveillance. Insurance ensures that these operations can continue smoothly without financial hiccups.

- Agriculture: Farmers use drones for crop monitoring and land surveying. Insurance covers damage to the drone and its expensive payload, like cameras and sensors.

- Film Production: Filmmakers rely on drones for aerial shots. Insurance protects the equipment and footage, ensuring that production can continue without delays.

Conclusion

When drones are becoming increasingly essential, UAS insurance is not just a luxury—it’s a necessity. It provides the peace of mind and financial protection needed to operate safely and legally. Next, we’ll explore the different components of UAS insurance policies in detail.

Key Components of UAS Insurance Policies

Physical Damage Coverage

Physical damage coverage is essential for protecting your unmanned aircraft and its components. This type of coverage typically includes:

- Unmanned Aircraft: Covers damage to the drone itself. This is crucial if your drone crashes or malfunctions.

- Payload: Protects valuable equipment attached to the drone, such as cameras, LIDAR lasers, and thermal sensors. For instance, if a drone carrying a high-end camera crashes, the insurance can cover the cost of the camera.

- Ground Equipment: Includes coverage for controllers, launchers, and other essential equipment used to operate the drone.

- Spare Parts: Ensures that you can quickly replace damaged parts and get your drone back in the air.

Third-Party Liability Coverage

Third-party liability coverage is vital for protecting against claims from others. This includes:

- Premises Liability: Covers injuries or property damage that occur on the premises where the drone is operated. For example, if your drone crashes into a car parked nearby, this coverage can help pay for the repairs.

- Personal Injury: Protects you from claims if your drone injures someone. Imagine accidentally hitting a bystander during a public event; personal injury coverage would handle the medical costs.

- Non-Owned Unmanned Aircraft Liability: Provides coverage if you operate a drone that you don’t own. This is useful for contractors or operators who use rented or borrowed drones.

- Product Liability: Covers claims related to any defects in the drone or its components that cause harm. For instance, if a malfunctioning part leads to an accident, product liability coverage can handle the legal and financial repercussions.

- War Liability: Protects against claims arising from acts of war or civil unrest. This is particularly relevant for drones used in high-risk areas.

- Terrorism Risk Insurance Act (TRIA): Offers coverage for damages resulting from acts of terrorism. This is crucial for operators working in sensitive or high-security areas.

By understanding and securing these key components of UAS insurance, you can ensure comprehensive protection for your unmanned aircraft, its equipment, and any potential liabilities. This coverage not only safeguards your investment but also provides peace of mind, allowing you to focus on your operations without worrying about unforeseen risks.

Next, we’ll explore how to choose the right UAS insurance for your specific needs.

How to Choose the Right UAS Insurance

Choosing the right UAS insurance can be a bit tricky, but focusing on a few key factors will help you make an informed decision. Here’s what to consider:

Factors to Consider

- Coverage Needs

- Physical Damage: Ensure your policy covers the drone, payload, and ground equipment.

- Liability: Look for third-party liability coverage to protect against property damage and personal injury claims.

Additional Coverage: Consider if you need extra protection for things like non-owned drones or specific high-risk operations.

Policy Limits

- Maximum Payout: Check the maximum payout amounts for both physical damage and liability claims.

Specific Limits: Some policies may have sub-limits for different components like payload or ground equipment. Make sure these are sufficient for your needs.

Exclusions

- Understand What’s Not Covered: Common exclusions may include wear and tear, mechanical breakdowns, or damage during illegal operations.

Read the Fine Print: Always read the policy details to know exactly what is excluded. This can save you from unpleasant surprises later.

Cost

- Premiums: Compare the premiums of different policies. Higher coverage limits and additional protections usually mean higher premiums.

- Deductibles: Look at the deductibles for each type of claim. A higher deductible can lower your premium but will cost you more out-of-pocket if you need to file a claim.

Making the Decision

When evaluating UAS insurance options, it’s crucial to balance cost with the level of coverage you need. Here are some steps to help you decide:

Assess Your Risks: Think about how and where you’ll be using your drone. For instance, a drone used for filming in crowded areas may need more liability coverage than one used in remote agricultural fields.

Get Multiple Quotes: Don’t settle for the first policy you find. Get quotes from multiple providers to compare coverage options and prices.

Consult an Expert: If you’re unsure about what coverage you need, consider speaking with an insurance advisor who specializes in UAS insurance. They can help you understand your risks and recommend the best coverage.

Review Policy Terms Regularly: As your operations and the UAS industry evolve, your insurance needs may change. Regularly review your policy to ensure it still meets your requirements.

By carefully considering these factors, you can choose a UAS insurance policy that offers the right balance of protection and affordability, ensuring that your unmanned aircraft operations are both safe and financially secure.

Next, we’ll look at some of the top UAS insurance providers to help you find the best fit for your needs.

Frequently Asked Questions about UAS Insurance

What is UAS in insurance?

Unmanned Aircraft System (UAS) refers to the entire system used to operate unmanned aerial vehicles (UAVs), commonly known as drones. This includes the drone itself, the control system, and any other associated equipment. In the context of UAS insurance, coverage is designed to protect all these components against various risks such as physical damage and liability.

What type of insurance does a UAS pilot need?

A UAS pilot typically needs several types of insurance to ensure comprehensive coverage:

- Hull Insurance: Covers physical damage to the drone itself, including the payload, cameras, and sensors.

- Liability Insurance: Protects against third-party claims for property damage and bodily injury. For example, if your drone accidentally crashes into a car, liability insurance would cover the repair costs.

- Payload Insurance: Specifically covers the valuable equipment attached to the drone, such as high-end cameras or LIDAR sensors.

- Ground Equipment Insurance: Covers the control systems and other ground-based equipment used to operate the drone.

- Personal Injury Insurance: Covers medical expenses if the pilot or others specified on the policy are injured during drone operations.

- Non-Owned Coverage: Protects you when operating a drone that you do not own, such as a rented or borrowed UAV.

What is considered a UAS?

A UAS includes not just the unmanned aircraft itself but also the ground control stations, data links, and other support equipment necessary for safe and efficient operations. A UAS is a complete system that allows for the remote operation of a drone, providing capabilities for tasks ranging from aerial photography to complex industrial inspections.

For more detailed information on UAS insurance and to get a personalized quote, visit NuSure Insurance.

Conclusion

In summary, UAS insurance is essential for anyone operating unmanned aircraft systems. Whether you’re a hobbyist or a commercial operator, the risks associated with flying drones are significant. Accidents can happen, and when they do, the financial and legal consequences can be severe.

UAS insurance provides comprehensive coverage that protects not just the drone but also the payload, ground equipment, and even against third-party liability. This means you’re covered for physical damages, personal injuries, and potential legal fees.

At NuWe understand the unique needs of drone operators. Our approach to UAS insurance is custom to provide you with the best coverage at competitive rates. We offer personalized quotes that match your specific requirements, whether you’re a photographer, real estate agent, or involved in industrial inspections.

Our policy monitoring ensures that you stay updated with the latest coverage options and regulatory requirements. This proactive approach helps you avoid gaps in coverage and ensures you are always protected.

Ready to secure your drone with comprehensive UAS insurance? Get a personalized quote from NuSure today. Protect your investment and fly with peace of mind.